BALANCE SHEET

Ploughback of business surplus

into the business (Rs. 205

crore as on March 31, 2017)

increased the shareholders’

funds even as the Company’s

equity remain unchanged at

Rs. 15.89 crore. Consequently,

the book value per share

increased from Rs. 121.98

as on March 31, 2016 to Rs.

147.91 as on March 31, 2017.

The Company’s external debt

portfolio declined from Rs.

293.66 crore as on March

31, 2016 to Rs. 213.16 crore

as on March 31, 2017. The

Company’s debt-equity ratio

declined from 0.28x as on

March 31, 2016 to 0.17x as

on March 31, 2017.

The Company’s Net Block

increased marginally from Rs.

1,120.51 crore as on March

31, 2016 to Rs. 1,177.29 crore

as on March 31, 2017 as there

was not much new capacity

addition during the year under

review except conversion of

ceramic tile unit into glazed

vitrified at Sikandrabad.

The Company plans to add

fresh capacity in the current

year which should add to its

Gross Block and increase the

provision for depreciation post

commissioning.

The Working Capital cycle

stood at 46 days in 2016-17

as against 44 days in 2015-16.

This increase was largely due

to a increase in receivables

due to competitive pressure

and a challenging market

environment.

The Company maintains a

system of well-established

policies and procedures for

internal control of operations

and activities. The team

continuously strive to integrate

the entire organisation from

strategic support functions

like finance, human resources,

and regulatory affairs to core

operations like research,

manufacturing and supply

chain. The internal audit

function is further strengthened

in consultation with statutory

auditors for monitoring

statutory and operational issues.

The Company has appointed

Ernst & Young LLP, Chartered

Accountants, as internal

auditors. The prime objective of

this audit is to test the adequacy

and effectiveness of all internal

control systems and suggest

improvements. Significant issues

are brought to the attention

of the audit committee for

periodical review.

The enterprise-wide risk

evaluation and validation

process is carried out regularly

by the Risk Management

Committee and the Board of

Directors.

Note: The figures for financial years 2015-2016 and 2016-17 are in accordance with Ind-AS and figures for other financial years

are as per Indian GAAP prevailing at that time.

CASH AND BANK BALANCE

RS. 51 CRORE AS ON MARCH

31, 2017

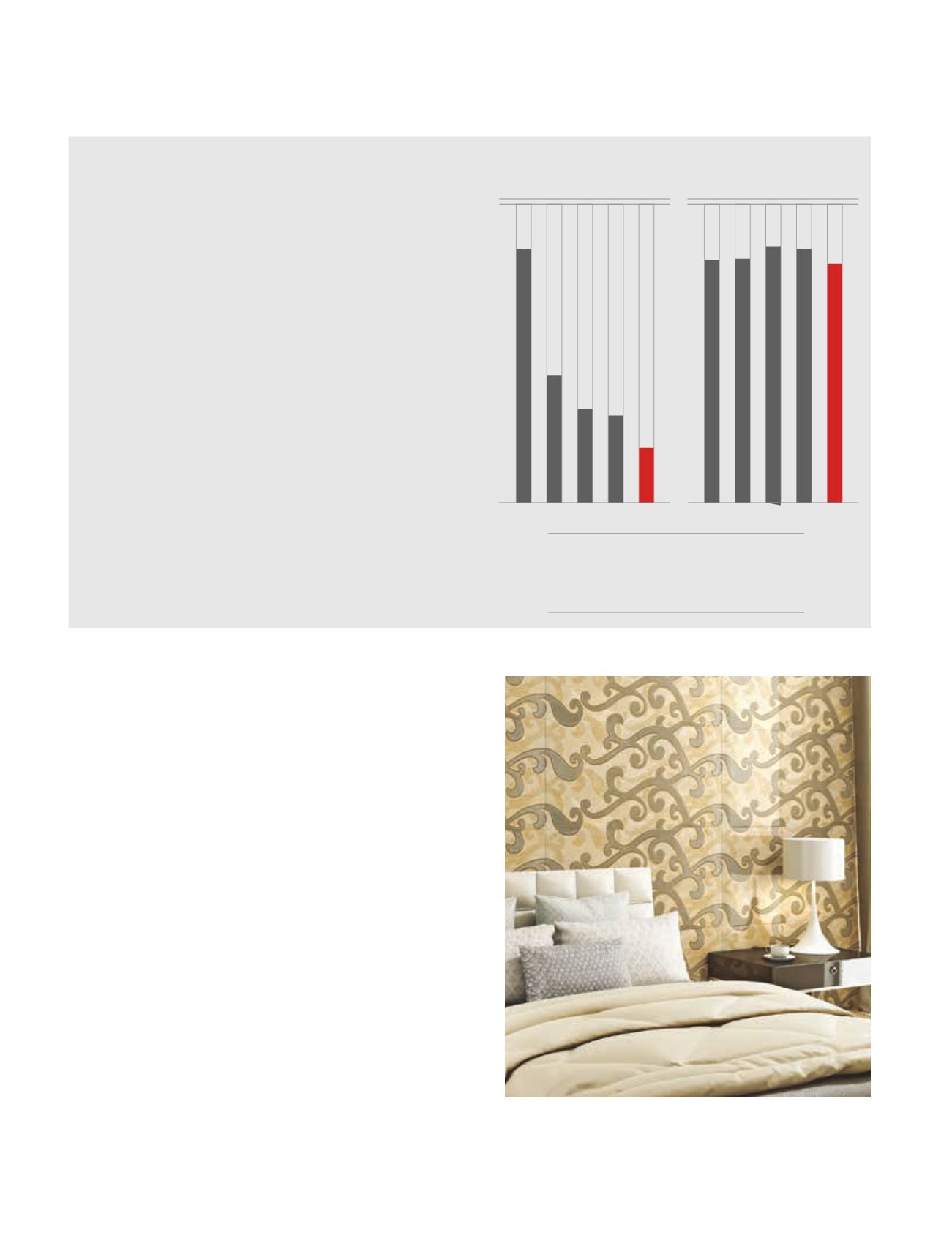

2012-13

2013-14

2014-15

2015-16

2016-17

0.82

0.41

0.30

0.28

0.17

Debt-equity

(x)

2012-13

2013-14

2014-15

2015-16

2016-17

28.89

29.06

30.49

30.08

28.39

Return on capital

employed

(%)

INTERNAL CONTROL SYSTEMS

AND THEIR ADEQUACY

028