products into in-house manufacturing

which facilitated in improving

organisational profitability.

The Company’s interest liability

declined marginally from Rs. 34.46

crore in 2015-16 to Rs. 34.00 crore

in 2016-17. The interest cover

strengthened from 11.47x in 2015-16

to 12.66x in 2016-17. The provision

for depreciation increased by 12%

from Rs. 72.61 crore in 2015-16 to

Rs. 81.39 crore in 2016-17 owing to

the full year depreciation charge on

assets capitalised in the previous year

and the commissioning of capital

projects in the current year.

An increase in net sales coupled

with optimising costs expanded the

Company’s EBIDTA by 8.50% from

Rs. 457.46 crore in 2015-16 to Rs.

496.33 crore in 2016-17. EBIDTA

margin also improved by 51 bps from

18.99% in 2015-16 to 19.50% in

2016-17.

Net profit for the year improved by

9% from Rs. 231.33 crore in 2015-16

to Rs. 252.84 crore in 2016-17; net

margins strengthened by 33 bps from

9.60% in 2015-16 to 9.93% in 2016-

17. This enabled the Company remain

steadfast on its commitment to grow

shareholder value – the management

declared a dividend of Rs. 3 per share.

EBIDTA MARGIN IMPROVED

BY 51 BPS FROM 18.99% IN

2015-16 TO 19.50% IN 2016-17.

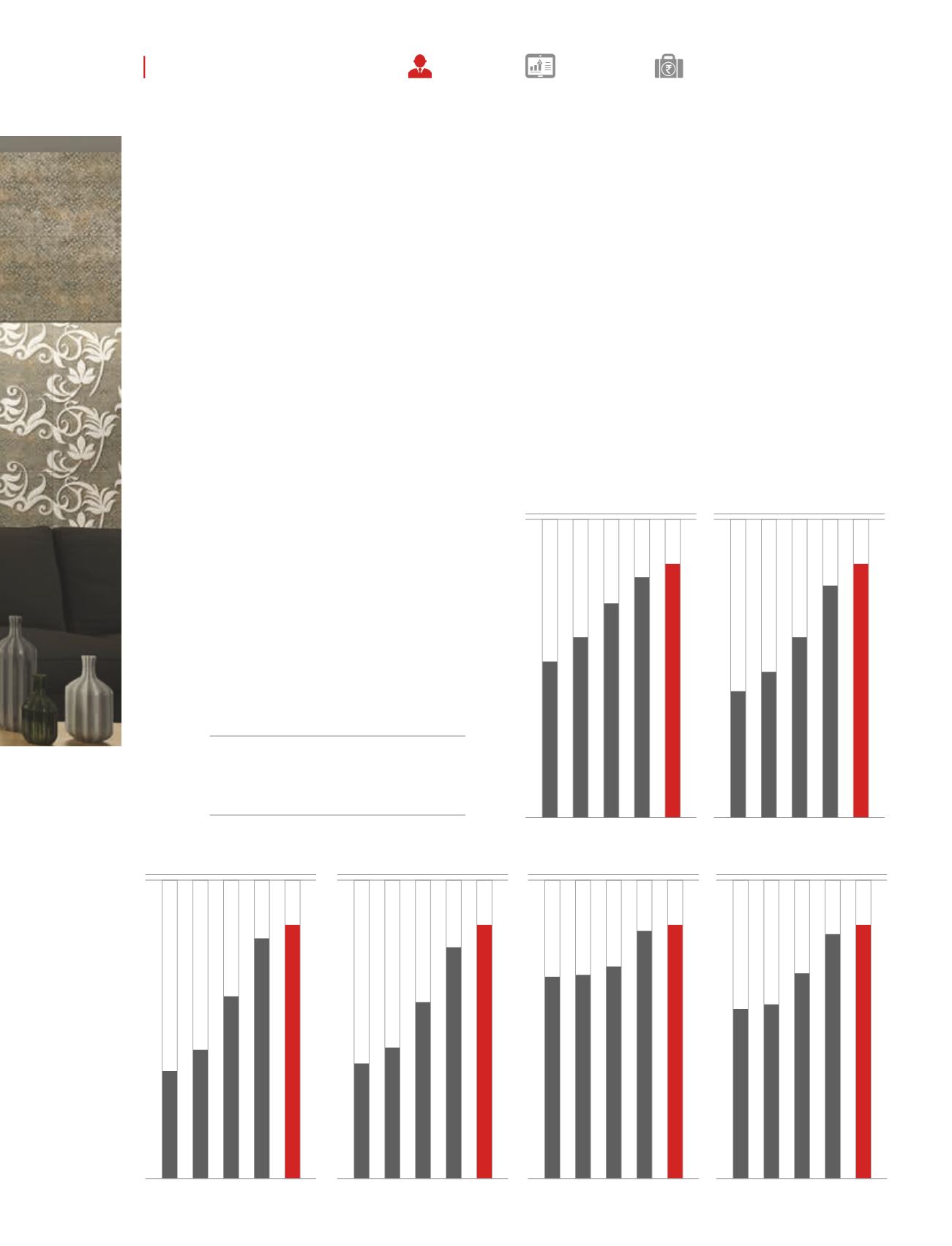

2012-13

2013-14

2014-15

2015-16

2016-17

1,734

2,015

2,404

2,696

2,851

Gross sales

(Rs. crore)

2012-13

2013-14

2014-15

2015-16

2016-17

245

285

354

457

496

EBIDTA

(Rs. crore)

2012-13

2013-14

2014-15

2015-16

2016-17

105

124

176

231

253

Net profit

(Rs. crore)

2012-13

2013-14

2014-15

2015-16

2016-17

15.46

15.59

16.26

18.99

19.50

EBIDTA margin

(%)

2012-13

2013-14

2014-15

2015-16

2016-17

149

171

231

304

334

Cash profit

(Rs. crore)

2012-13

2013-14

2014-15

2015-16

2016-17

6.61

6.79

8.06

9.60

9.93

Net profit margin

(%)

027

ANNUAL

REPORT

20

16-17

KAJARIA

CERAMICS

CORPORATE

OVERVIEW

MANAGEMENT

REPORTS

FINANCIAL

STATEMENTS