DIRECTORS’

REPORT

Your Directors are pleased to present the 31st Annual Report together with the audited financial

statements of your Company for the financial year ended 31st March 2017.

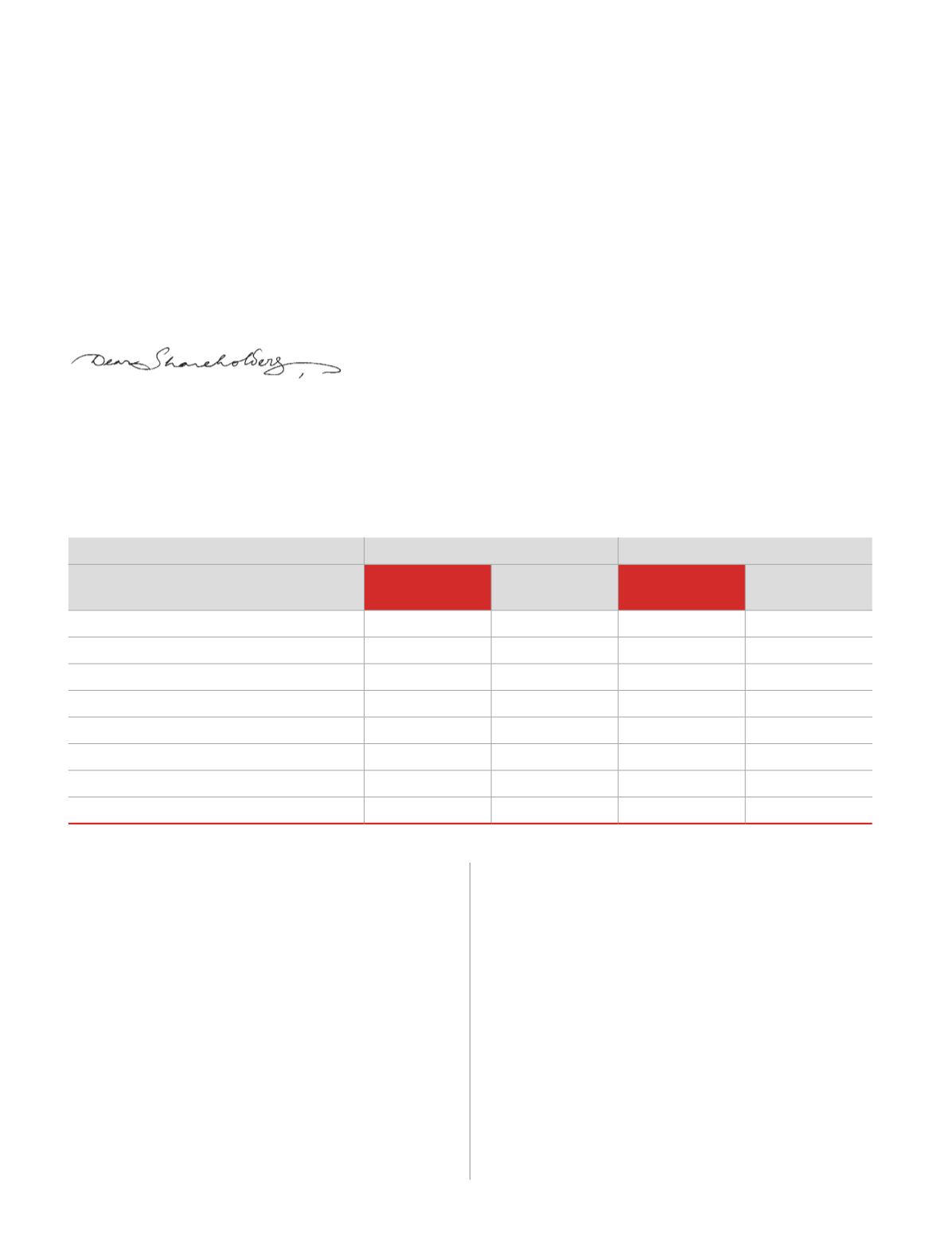

Financial Results

The Company’s financial performance for the year ended on 31st March 2017 is summarised below:

(Rs. in crore)

Particular

Standalone

Consolidated

Year ended

31st March 2017

Year ended

31st March 2016

Year ended

31st March 2017

Year ended

31st March 2016

Revenue (Net Sales)

2526

2441

2546

2409

Profit Before Depreciation, Interest and taxes

439

384

496

457

Profit before Tax

407

355

396

361

Tax Expense

137

118

142

125

Profit After Tax (before Minority interest)

270

237

254

236

Minority Interest

-

-

1

5

Profit After Tax (after Minority interest)

270

237

253

231

Transferred to General Reserve

75

60

75

60

Financial highlights & State of Affairs of the

Company

(The financial discussion is based on Standalone Financial

Statements)

Your Company registered 3.48% growth in net sales from Rs.

2441 crores in 2015-16 to Rs. 2526 crores in 2016-17 despite

the subdued sentiment prevailing in the real estate industry

and the temporary disruption in the cash economy due to

demonetization. This uptick largely owned to new product

launches during the year under review which were well received

by customer pan-India.

Earnings before interest depreciation and tax (EBIDTA) increased

by 14% from Rs. 384 crore in 2015-16 to Rs. 439 crore in 2016-

17 due to increased sales of value-added tiles, cost optimization

arising from shopfloor efficiencies. The profit after tax grew by

14% from Rs. 237 crore in 2015-16 to Rs. 270 crore in 2016-17.

The earnings per share (basic) increased from Rs. 14.87 in 2015-

16 to Rs. 16.96 in 2016-17.

The State of affairs of the Company is detailed in the

“Management Discussion & Analysis” section which forms part

of this report.

Outlook

Investment-inducing and business-strengthening Government

policies coupled with growing affluence and soaring aspiration

are expected to sustain the sectoral growth momentum over

the coming years. Further, the promise of industry consolidation

arising out of Government policies, raises the hopes for widening

growth opportunities over the medium term.

034