Operating cost and EBIDTA

An increase in business scale – more volumes, more

locations and more people – would justify an increase

in operational costs. Besides, increasing fuel costs and

rupee depreciation only added to the cost structure.

Under such circumstances, it would have been

reasonable to estimate a reduced operating profit.

At Kajaria, it was different. While fuel cost doubled

between 2009-10 and 2013-14, the rupee depreciated

sharply, the wage cost increased consistently over the

period under review; operating cost as a proportion

of net sales remained largely stable – at 83.82% in

2009–10, 85.91% in 2012-13 and 82.97% in 2013-14.

EBIDTA jumped more than two-fold between 2009-10

and 2013-14.

This increase in profitability was possible due to a

single-minded focus on creating a demand for value-

added tiles as well as a process realignment to increase

productivity and eliminate wastage.

Dividend and ploughback

The Company needs to tread a balance between

rewarding shareholders with a high dividend and

retaining surplus for capital-intensive projects. Generally,

one increases at the compromise of the other. At Kajaria,

this did not happen. For one, increasing volumes,

increased value-addition, optimised costs and reduced

interest outflow accelerated net profit growth faster

than others in the tile industry. Hence, while dividend

payout to shareholders grew 78.20% CAGR over the

five years (upto 2013-14), the ploughback of business

surplus leapfrogged 67.01% CAGR over the same period.

In 2013-14, the dividend payout at

`

264.54 million and

the surplus ploughback at

`

932.71 million were 20%

and 18% higher than the previous year’s allocations.

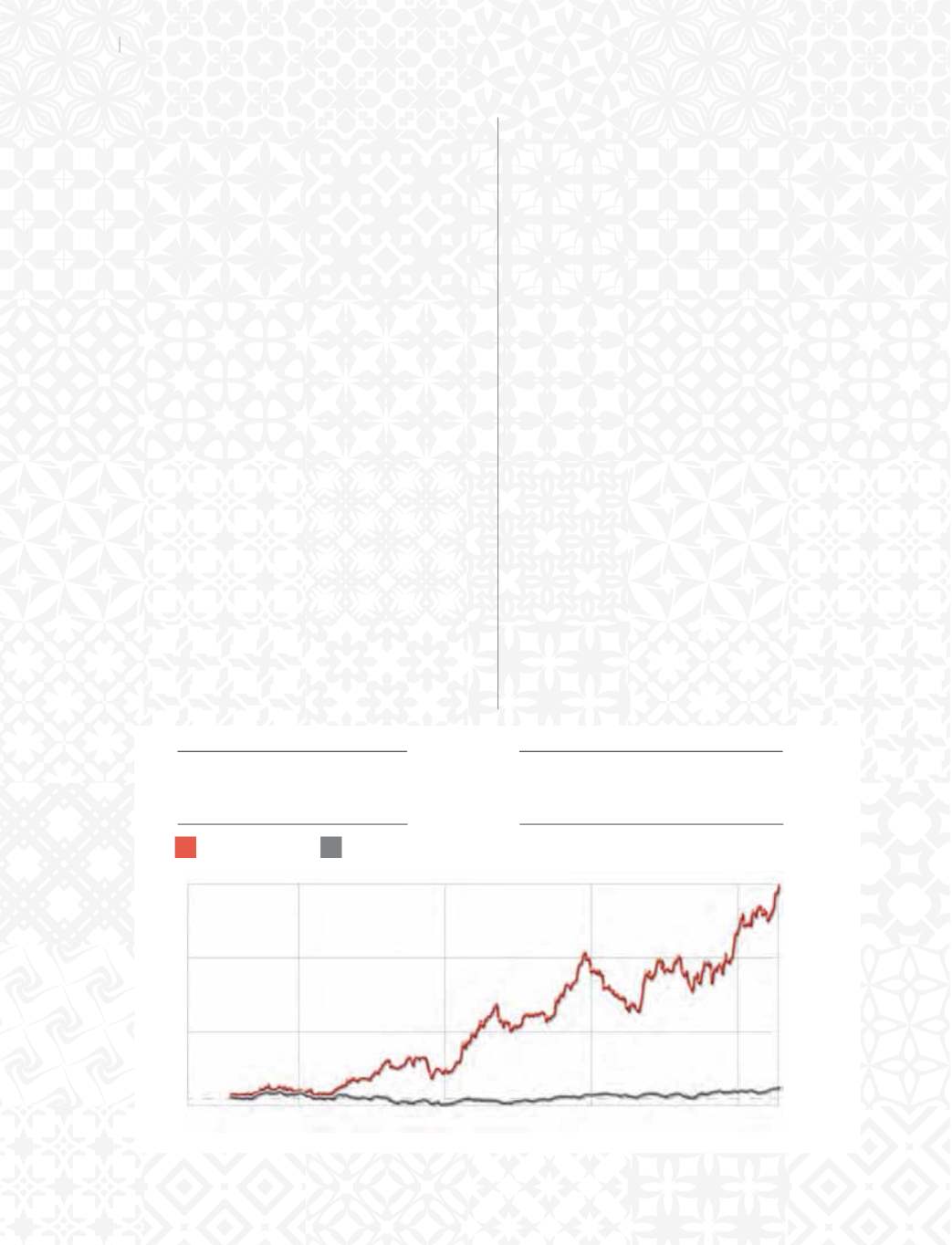

As a result, shareholder value doubled - incremental

income (through growing dividend) and growing wealth

(through outperformance of the share price with the

broader index).

Internal control and adequacy

The Company maintains a system of well-established

policies and procedures for internal control of operations

and activities.

The internal control systems consist of comprehensive

internal and statutory audits. Internal auditors

independently evaluate adequacy of internal controls

and concurrently audit majority of transactions in value

terms. The internal audit function is further strengthened

in consultation with Statutory Auditors for monitoring

statutory and operational issues. Independence of the

audit and compliance function is ensured by the direct

reporting of the internal audits to the Audit Committee

of the Board.

2010

2011

2012

2013

2014

Kajaria Ceramics

`

349

Market price

March 31, 2014

Returns

over 4 years

477.55%

SENSEX

22,386

March 31, 2014

Returns

over 4 years

26.53%

Kajaria Ceramics

SENSEX

28

Kajaria Ceramics Limited