Kajaria registered healthy growth despite the numerous challenges faced by the domestic tile manufacturers.

Interestingly, the Company has sustained profitable business growth over the last 4-5 years.

In 2013-14, we will not highlight the performance with the previous year, but analyse how Kajaria has created

strong financial statements and multiplied shareholder value in the face of a persistent economic slowdown.

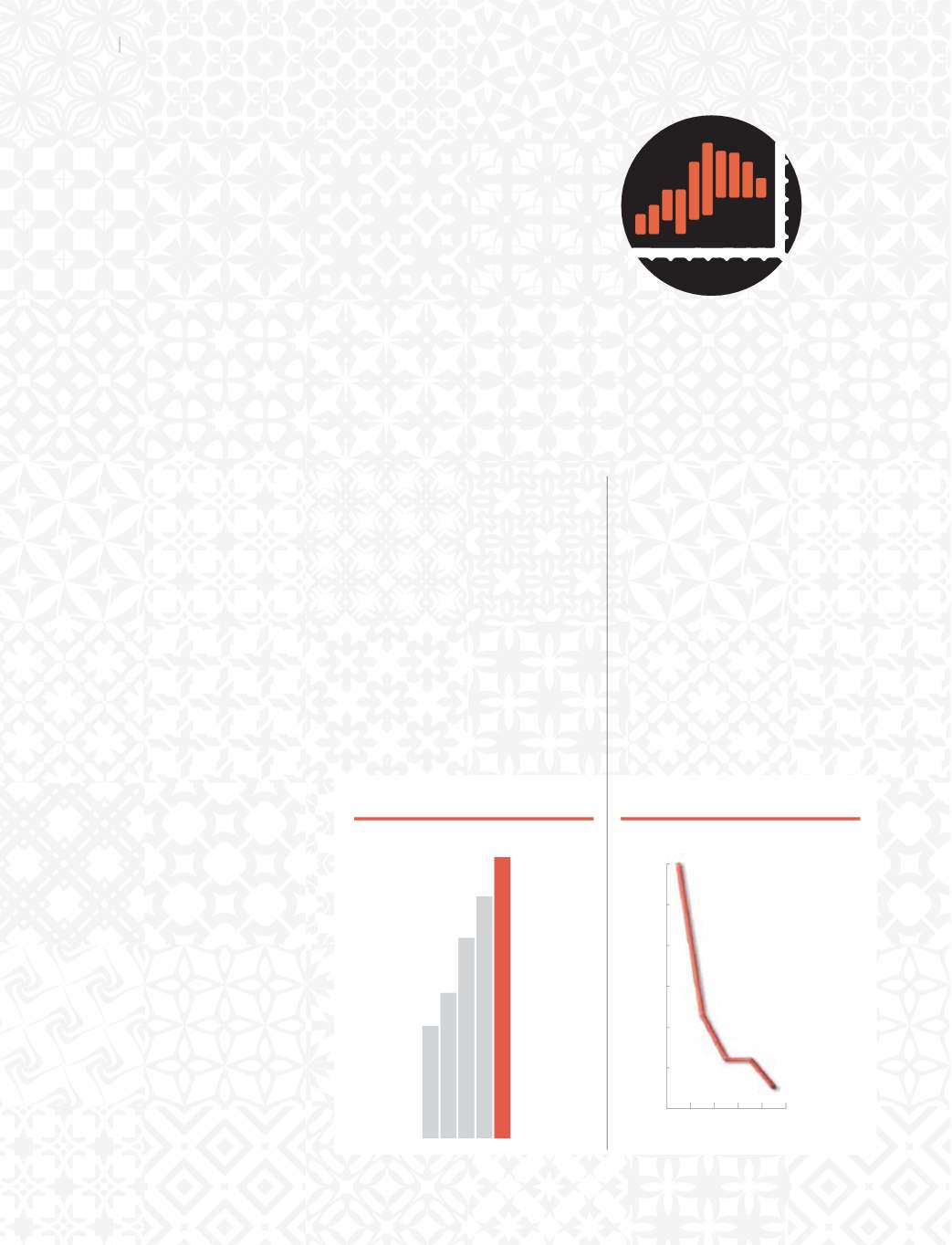

Topline and working capital

Net sales grew by 16.22% over

2012-13; more importantly net sales

grew at 22.56% CAGR (five-year) due

to a value-volumes play marked by a

consumer pull.

Normally, an increase in the scale

of business is accompanied by

an increase in working capital

requirement. For Kajaria, the reverse

transpired; working capital declined

from 80 days of turnover equivalent

in 2009-10 to 32 days in 2012-13

and 25 days in 2013-14 (an industry

benchmark). This was largely due to

a faster product offtake and faster

payments by the dealers. What makes

the working capital reduction even

more interesting is that this transpired

despite a reduction in the creditors’

cycle from 66 days in 2009-10 to 47

days in 2013-14.

The shorter working capital cycle

increased net cash from operations

– at

`

1,661 million in 2013-14, an

increase of 70% over 2012-13.

Analysis

of financial

statements

Net sales

(

`

million)

2009-10

2010-11

2011-12

2012-13

2013-14

7,355

9,523

13,115

15,822

18,387

Working capital cycle

(days)

2009-10

2010-11

2011-12

2012-13

2013-14

80

43

32 32

25

26

Kajaria Ceramics Limited