Gross block and debt

Gross block increased 11.32% over

2012-13; it grew at 15.34% CAGR

(5 years) as the Company expanded its

manufacturing base in West and South

India, increased capacity in North India

and invested in improvement and

modernisation across all units. In the

last five years, the Company invested

`

5,612 million in its gross block.

One would imagine that these

sizeable investments would have

significantly increased the Company’s

debt burden or the reserves would

have been depleted. The reality was

the opposite. Debt as a percentage of

capital employed reduced from 52% in

2009-10 to 41% in 2012-13 and 27%

in 2013-14. Debt-equity ratio stood at

0.41x as on March 31, 2014 against

1.39x as on March 31, 2010, largely

due to the healthy cash flow, working

capital reduction and equity infusion

As debt declined, interest liability

dropped – interest, which was 4.89%

of turnover in 2009-10 stood at only

2.02% of turnover in 2013-14. The

interest cover (showcases the strength

to repay interest liability) strengthened

to 5.88x in 2013-14 from 2.37x in

2009-10.

The Company’s reserves and surplus

stood at

`

5140 million as on March

31, 2014 – 48.50% higher than the

balance as on March 31, 2013 and a

growth of 28.39% (CAGR) over the

balance as on March 31, 2010.

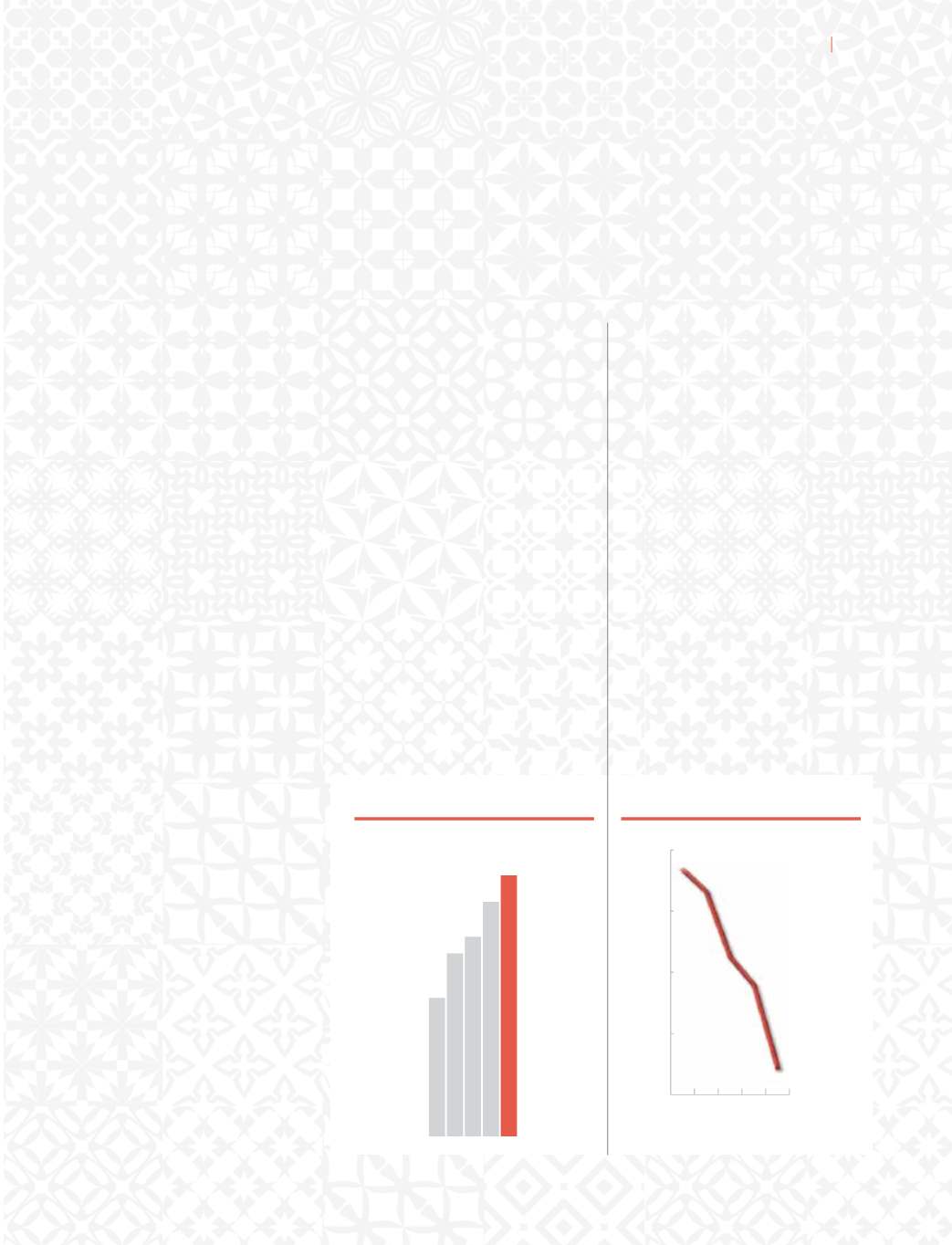

Gross block

(

`

million)

2009-10

2010-11

2011-12

2012-13

2013-14

5,435

7,178

7,827

9,195

10,235

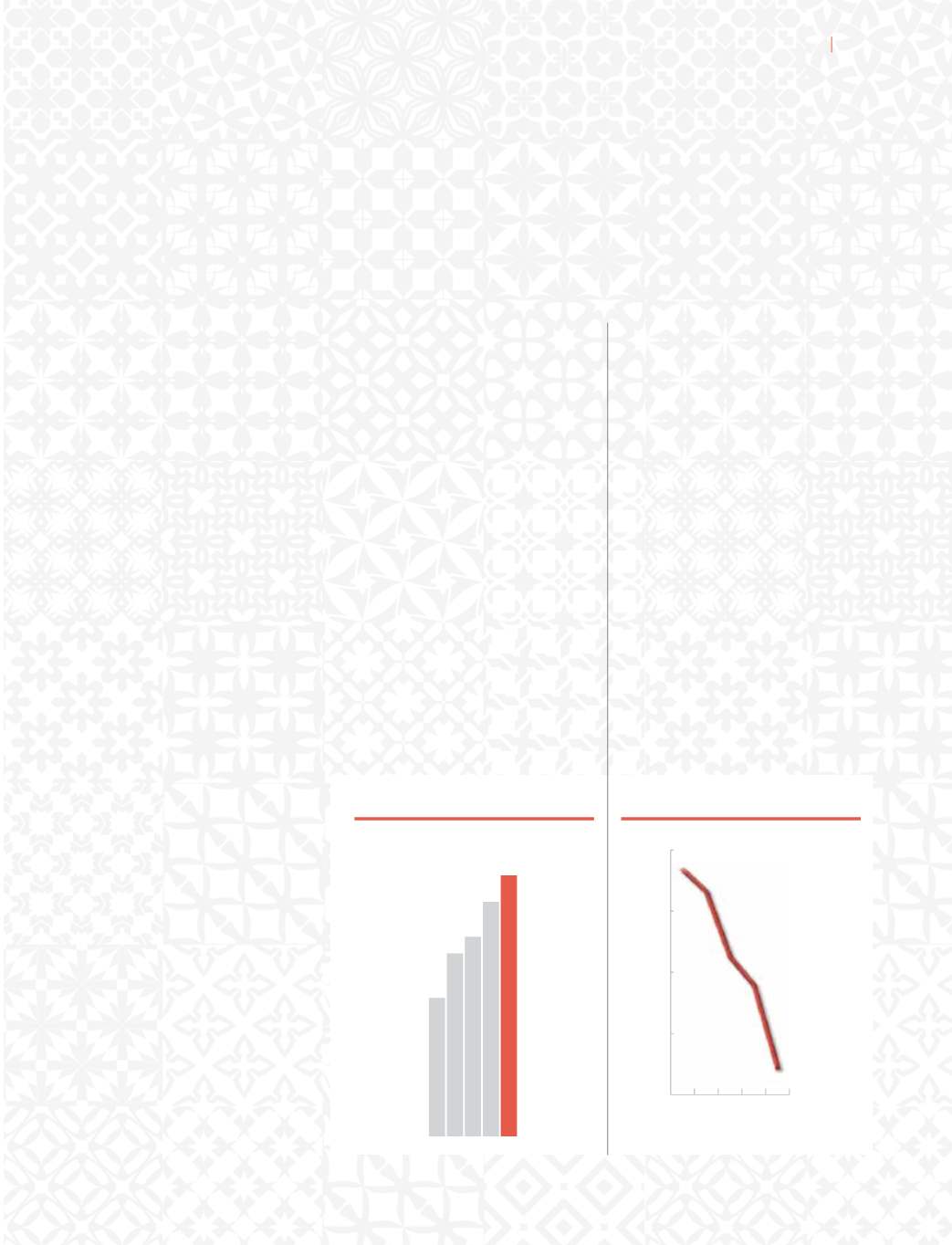

Debt-equity

(x)

2009-10

2010-11

2011-12

2012-13

2013-14

1.39

1.28

0.96

0.82

0.41

27

Annual Report 2013-14