145

annual

report

20

16-17

kajaria

ceramics

corporate

overview

management

reports

Financial

statements

41. Financial risk management objectives and policies

II. Credit risk

Credit risk is the risk that counterparty will not meet its obligations under a financial instrument or customer contract,

leading to a financial loss. The Company is exposed to credit risk from its operating activities (primarily trade receivables)

and from its financing activities, including deposits with banks and financial institutions.

Credit risk from investments with banks and other financial institutions is managed by the Treasury functions in accordance

with the management policies. Investments of surplus funds are only made with approved counterparties who meet the

appropriate rating and/or other criteria, and are only made within approved limits. The management continually re-assess

the Company’s policy and update as required. The limits are set to minimise the concentration of risks and therefore

mitigate financial loss through counterparty failure.

The maximum credit risk exposure relating to financial assets is represented by the carrying value as at the Balance Sheet

date

A. Trade receivables

Customer credit risk is managed by each business unit subject to the Company’s established policy, procedures and

control relating to customer credit risk management. Credit quality of a customer is assessed based on an extensive

credit review and individual credit limits are defined in accordance with this assessment. Outstanding customer

receivables are regularly monitored.

At the year end the Company does not have any significant concentrations of bad debt risk other than that disclosed

in note 9.

An impairment analysis is performed at each reporting date on an individual basis for major clients. The calculation is

based on historical data. The maximum exposure to credit risk at the reporting date is the carrying value of each class

of financial assets disclosed in Note 39. The Company does not hold collateral as security. The Company evaluates the

concentration of risk with respect to trade receivables as low, as its customers are located in several jurisdictions and

operate in largely independent markets.

B. Financial instruments and cash deposits

Credit risk from balances with banks and financial institutions is managed by the Company’s treasury department in

accordance with the Company’s policy. Investments of surplus funds are made only with approved counterparties.

III. Liquidity risk

The Company’s objective is to maintain a balance between continuity of funding and flexibility through the use of bank

overdrafts.

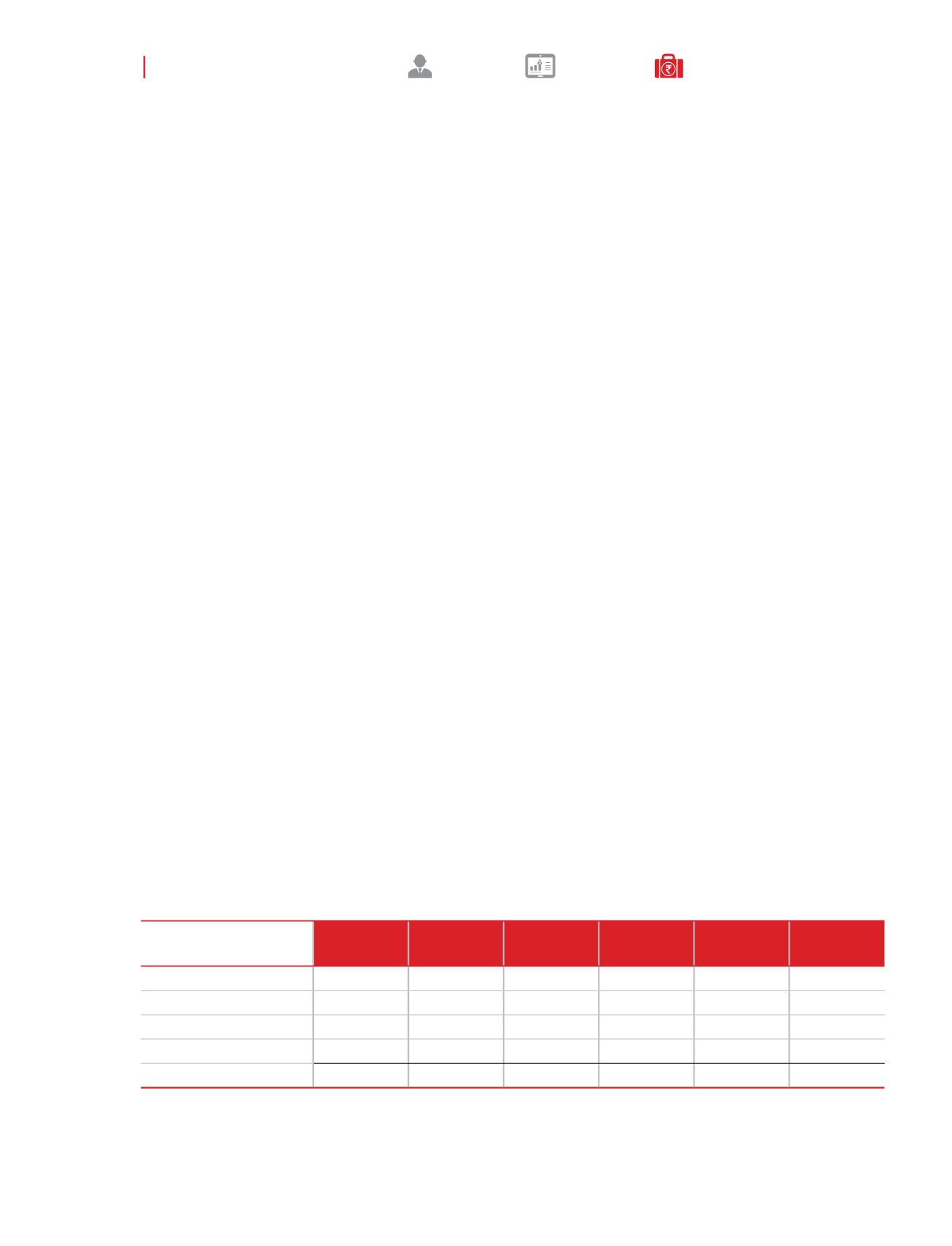

The table below summarises the maturity profile of the Company’s financial liabilities based on contractual undiscounted

payments.

(

`

in crores)

On demand Less than 3

months

3 to 12

months

1 to 5 years > 5 years

Total

Year ended 31-Mar-17

Borrowings*

7.78

0.12

0.14

5.19

13.23

Trade payables

20.36

205.11

2.68

-

-

228.15

Other financial liabilities

40.02

3.62

21.13

-

-

64.77

68.16

208.85

23.95

-

5.19

306.15

Notes on the standalone financial statements

for the year ended 31 March 2017