142

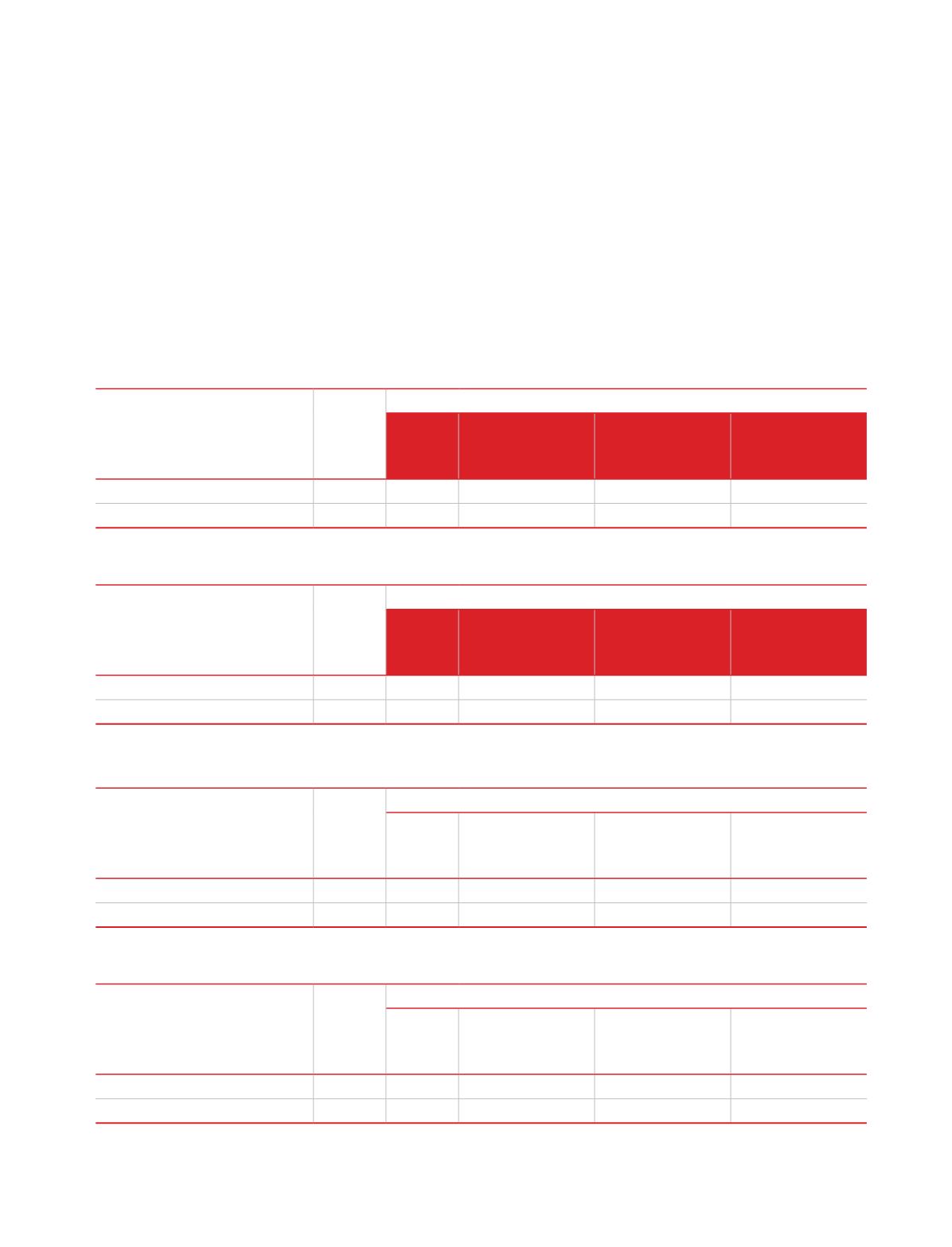

40. Fair value hierarchy

All financial instruments for which fair value is recognised or disclosed are categorised within the fair value hierarchy,

described as follows, based on the lowest level input that is insignificant to the fair value measurements as a whole.

Level 1 : quoted (unadjusted) prices in active markets for identical assets or liabilities.

Level 2 : valuation techniques for which the lowest level inputs that has a significant effect on the fair value measurement

are observable, either directly or indirectly.

Level 3 : valuation techniques for which the lowest level input which hass a significant effect on fair value measurement is

not based on observable market data.

(

`

in crores)

Date of

valuation

Fair value measurement using

Total

Quoted prices in

active markets

(Level 1)

Significant

observable inputs

(Level 2)

Significant

unobservable

inputs (Level 3)

Assets measured at fair value:

Security deposits

31-Mar-17 8.48

-

-

8.48

The following table provides the fair value measurement hierarchy of the Company’s assets and liabilities.

Quantitative disclosures fair value measurement hierarchy for assets as at 31 March 2017:

(

`

in crores)

Date of

valuation

Fair value measurement using

Total

Quoted prices in

active markets

(Level 1)

Significant

observable inputs

(Level 2)

Significant

unobservable

inputs (Level 3)

Liabilities measured at fair value:

Borrowings

31-Mar-17 2.70

-

-

2.70

There have been no transfers between Level 1 and Level 2 during the period.

Quantitative disclosures fair value measurement hierarchy for liabilities as at 31 March 2017:

(

`

in crores)

Date of

valuation

Fair value measurement using

Total

Quoted prices in

active markets

(Level 1)

Significant

observable inputs

(Level 2)

Significant

unobservable

inputs (Level 3)

Assets measured at fair value:

Security deposits

31-Mar-16 7.44

-

-

7.44

There have been no transfers between Level 1 and Level 2 during the period.

Quantitative disclosures fair value measurement hierarchy for liabilities as at 31 March 2016:

(

`

in crores)

Date of

valuation

Fair value measurement using

Total

Quoted prices in

active markets

(Level 1)

Significant

observable inputs

(Level 2)

Significant

unobservable

inputs (Level 3)

Liabilities measured at fair value:

Borrowings

31-Mar-16 2.42

-

-

2.42

There have been no transfers between Level 1 and Level 2 during year ended 31 March 2016.

There have been no transfers between Level 1 and Level 2 during the year ended 31 March 2016.

Quantitative disclosures fair value measurement hierarchy for liabilities as at 31 March 2016:

Notes on the standalone financial statements

for the year ended 31 March 2017