144

41. Financial risk management objectives and policies

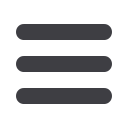

A. Interest rate risk

Interest rate risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because

of changes in market interest rates. The Company’s exposure to the risk of changes in market interest rates relates

primarily to the Company’s debt obligations with floating interest rates. However the risk is very low due to negligible

borrowings by the Company.

Increase/

decrease in

basis points

Effect on profit

before tax

`

Crores

31-Mar-17

INR

+50

(0.06)

INR

-50

0.06

31-Mar-16

INR

+50

(0.17)

INR

-50

0.17

The assumed movement in basis points for the interest rate sensitivity analysis is based on the currently observable

market environment, showing a significantly higher volatility than in prior years.

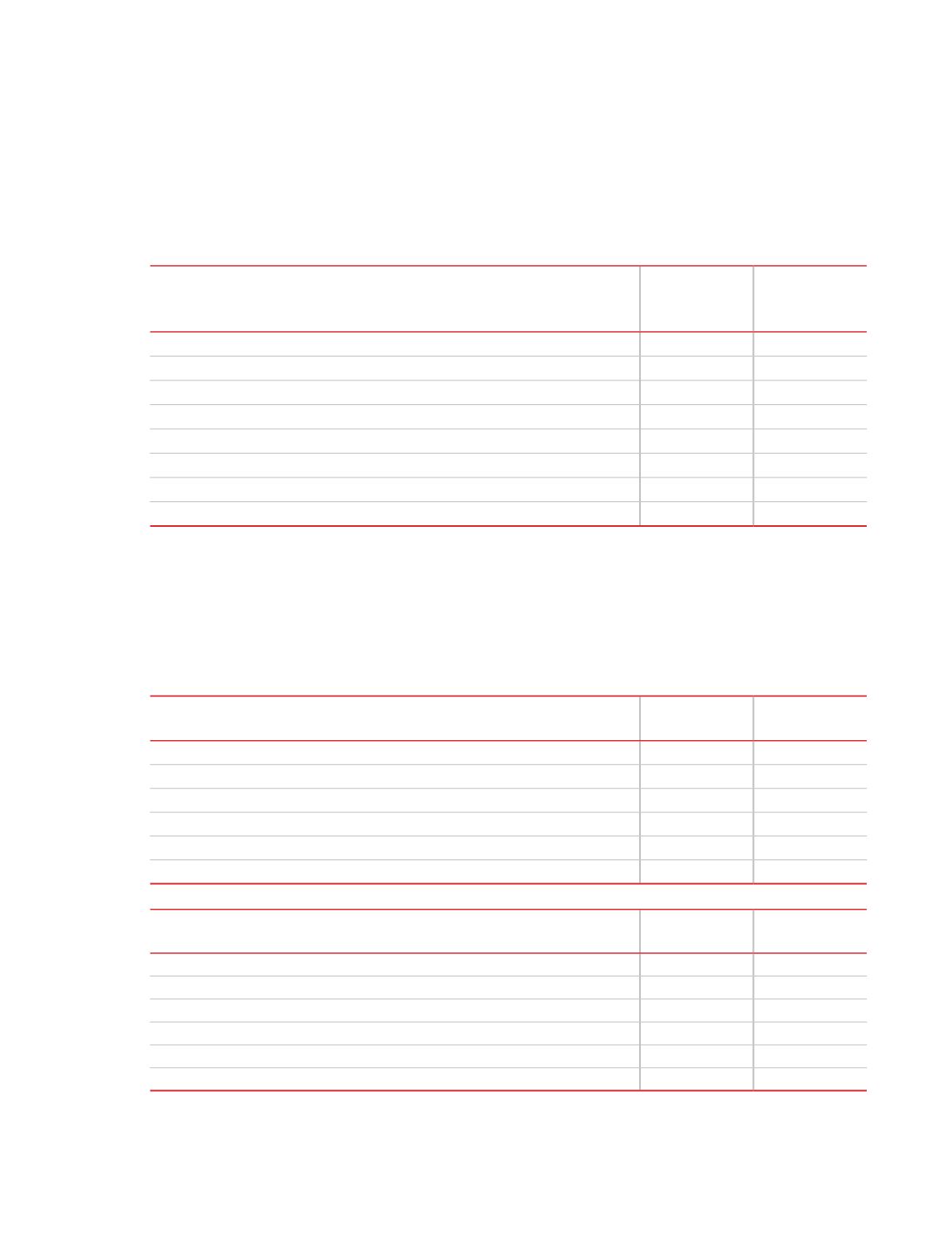

B. Foreign currency sensitivity

Foreign currency risk is the risk that the fair value of future cash flows of an exposure will fluctuate because of changes

in exchange rates. Foreign currency risk senstivity is the impact on the Company’s profit before tax is due to changes

in the fair value of monetary assets and liabilities. The following tables demonstrate the sensitivity to a reasonably

possible change in USD and EURO exchange rates, with all other variables held constant.

Change in USD

rate

Effect on profit

before tax

`

in crores

31-Mar-17

+5%

0.07

-5%

(0.07)

31-Mar-16

+5%

(0.35)

-5%

0.35

Change in

EURO rate

Effect on profit

before tax

`

in crores

31-Mar-17

+5%

(1.08)

-5%

1.08

31-Mar-16

+5%

(1.01)

-5%

1.01

The movement in the pre-tax effect on profit and loss is a result of a change in the fair value of derivative financial

instruments not designated in a hedge relationship and monetary assets and liabilities denominated in INR, where the

functional currency of the entity is a currency other than INR.

Notes on the standalone financial statements

for the year ended 31 March 2017