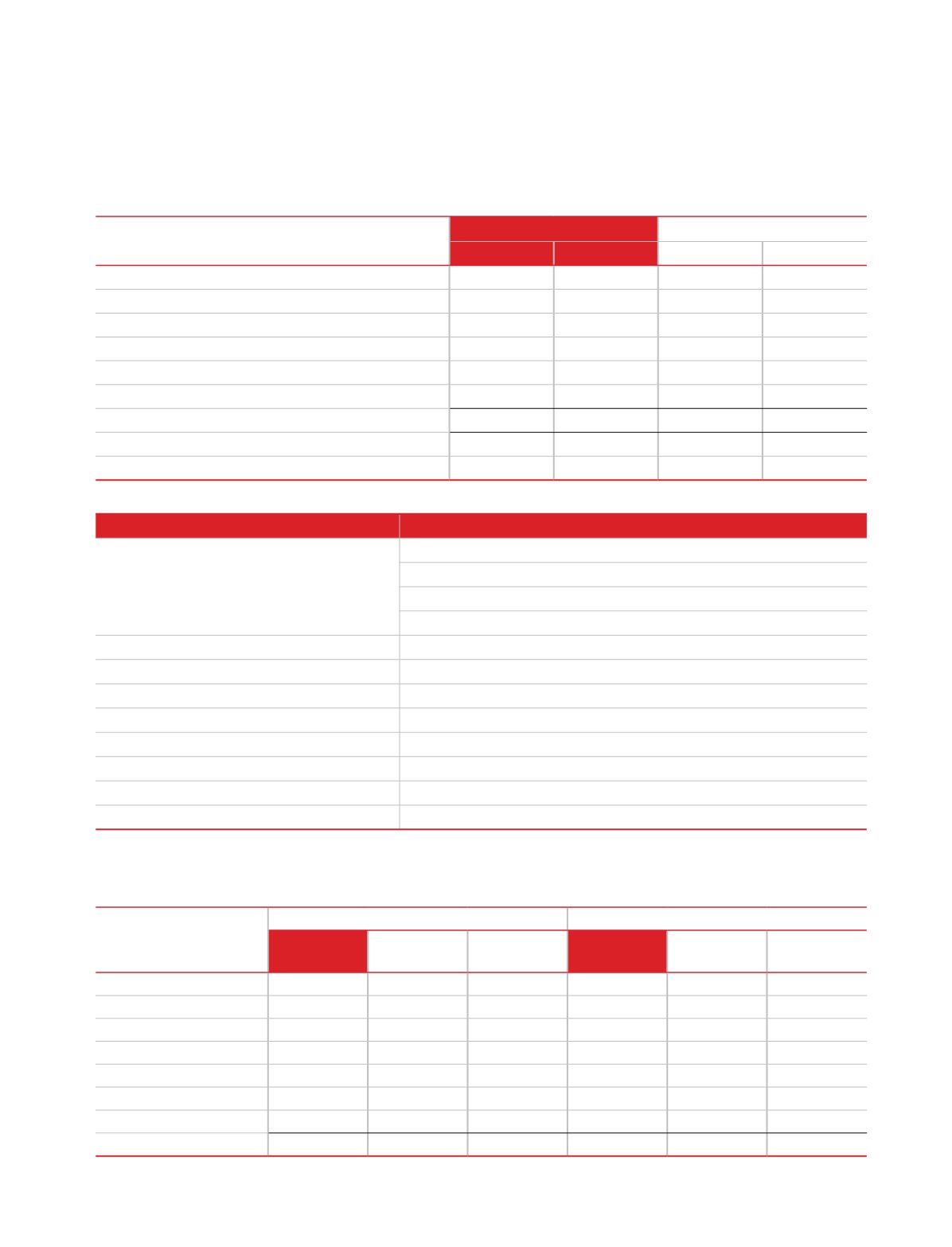

140

(

`

in crores)

31 March 2017

31 March 2016

Number

WAEP

Number

WAEP

Oustanding at 1 April

229,000

425

-

-

Granted during the year

229,000

850

Share spilt during the year (refer note '13C')

229,000

425

-

-

Forfeited during the year

(40,000)

425

-

-

Exercised during the year

-

-

-

-

Expired during the year

-

-

-

-

Outstanding at 31 March

418,000

229,000

Exercisable at 31 March

0

0

38. Share Based Payments

(contd...)

Movements during the year

The following table illustrates the number and weighted average exercise prices (WAEP) of, and movements in, share options

during the year:

Particulars of Scheme

Name of scheme

Employee Stock Option Plan 2015

Vesting conditions

45,800 options 24 months after the grant date (‘First vesting’)

91,600 options 36 months after the grant date (‘Second vesting’)

1,37,400 options 48 months after the grant date (‘Third vesting’)

1,83,200 options 60 months after the grant date (‘Fourth vesting’)

Exercise period

Stock options can be exercised within a period of 8 years from grant date.

Number of share options

4,58,000

Exercise Price

`

425

Remaining Life as on 31.03.2017

3.50 years

Note:

Adjusted for share split post approval of the scheme

(

`

in crores)

Carrying value

Fair value

As at

31- Mar- 2017

As at

31-Mar-2016

As at

1-Apr-2015

As at

31- Mar- 2017

As at

31-Mar-2016

As at

1-Apr-2015

Financial assets

Investments

108.89

108.89

79.19

108.89

108.89

79.19

Loans

200.15

161.07

159.90

200.15

161.07

159.90

Trade receivables

305.90

252.20

199.89

305.90

252.20

199.89

Cash and cash equivalents

47.16

3.39

4.94

47.16

3.39

4.94

Other bank balances

1.51

1.42

1.11

1.51

1.42

1.11

Other financial assets

1.48

0.60

4.26

1.48

0.60

4.26

Total

665.09

527.57

449.29

665.09

527.57

449.29

39. Fair values

Set out below, is a comparison by class of the carrying amounts and fair value of the Company’s financial instruments.

Notes on the standalone financial statements

for the year ended 31 March 2017