148

48

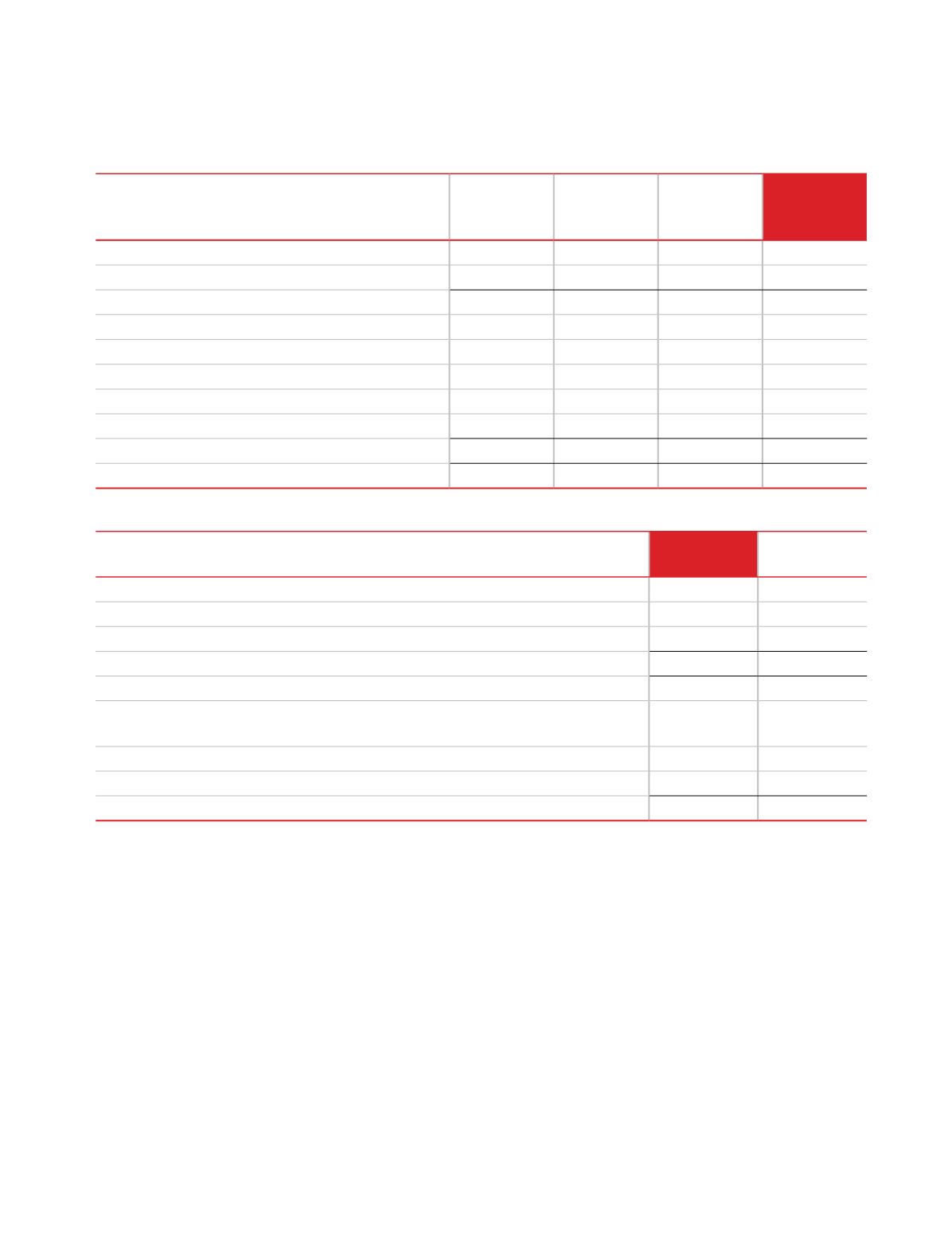

Disclosure of Movement in Provisions during the year as per Ind AS- 37,

‘Provisions, Contingent Liabilities and Contingent Assets :

(

`

in crores)

Particulars

Balance as on

1 April 2016

Provided

during the

year

Paid/Adjusted

During the

year

Balance as on

31 March

2017

Non-current provisions

Gratuity

9.31

3.73

3.09

9.95

Total

9.31

3.73

3.09

9.95

Current provisions

Gratuity

0.67

0.67

0.67

0.67

Accumulated leaves

7.99

3.61

2.26

9.34

Income Tax

11.69

122.17

126.74

7.12

Total

20.35

126.45

129.67

17.13

Grand total

29.66

130.18

132.76

27.08

(

`

in crores)

Year ended

March 31, 2017

Year ended

March 31, 2016

A. Declared and paid during the year:

Final dividend for FY 2015-16:

`

5 per share (FY 2014-15:

`

4 per share)

47.83

38.14

(Including dividend distribution tax of

`

8.09 crores, FY 2015-16

`

6.36 crores)

47.83

38.14

B. Proposed for approval at the annual general meeting (not recognised as a

liability):

Final dividend for FY 2016-17:

`

3 per share (2015-16:

`

5 per share)

47.68

39.74

Dividend distribution tax

9.71

8.09

57.39

47.83

Note:

Note: Final dividend for FY 2016-17 is proposed on equity shares of face value of

`

1 per share after share split. All other

per share figures are in respect of equity shares of face value of

`

2 per share. (refer note 13C)

49 Dividends Paid and Proposed

50 First time adoption of Ind AS

These financial statements, for the year ended 31 March 2017, are the first the Company has prepared in accordance with

Ind AS. For periods up to and including the year ended 31 March 2016, the Company prepared its financial statements in

accordance with accounting standards notified under section 133 of the Companies Act 2013, read together with paragraph

7 of the Companies (Accounts) Rules, 2014 (Previous GAAP).

Accordingly, the Company has prepared financial statements which comply with Ind AS applicable for periods ending on 31

March 2017, together with the comparative period data as at and for the year ended 31 March 2016, as described in the

summary of significant accounting policies. In preparing these financial statements, the Company’s opening balance sheet was

prepared as at 1 April 2015, the Company’s date of transition to Ind AS. This note explains exemptions availed by the Company

in restating its Previous GAAP financial statements, including the balance sheet as at 1 April 2015 and the financial statements

as at and for the year ended 31 March 2016.

Notes on the standalone financial statements

for the year ended 31 March 2017