141

annual

report

20

16-17

kajaria

ceramics

corporate

overview

management

reports

Financial

statements

(

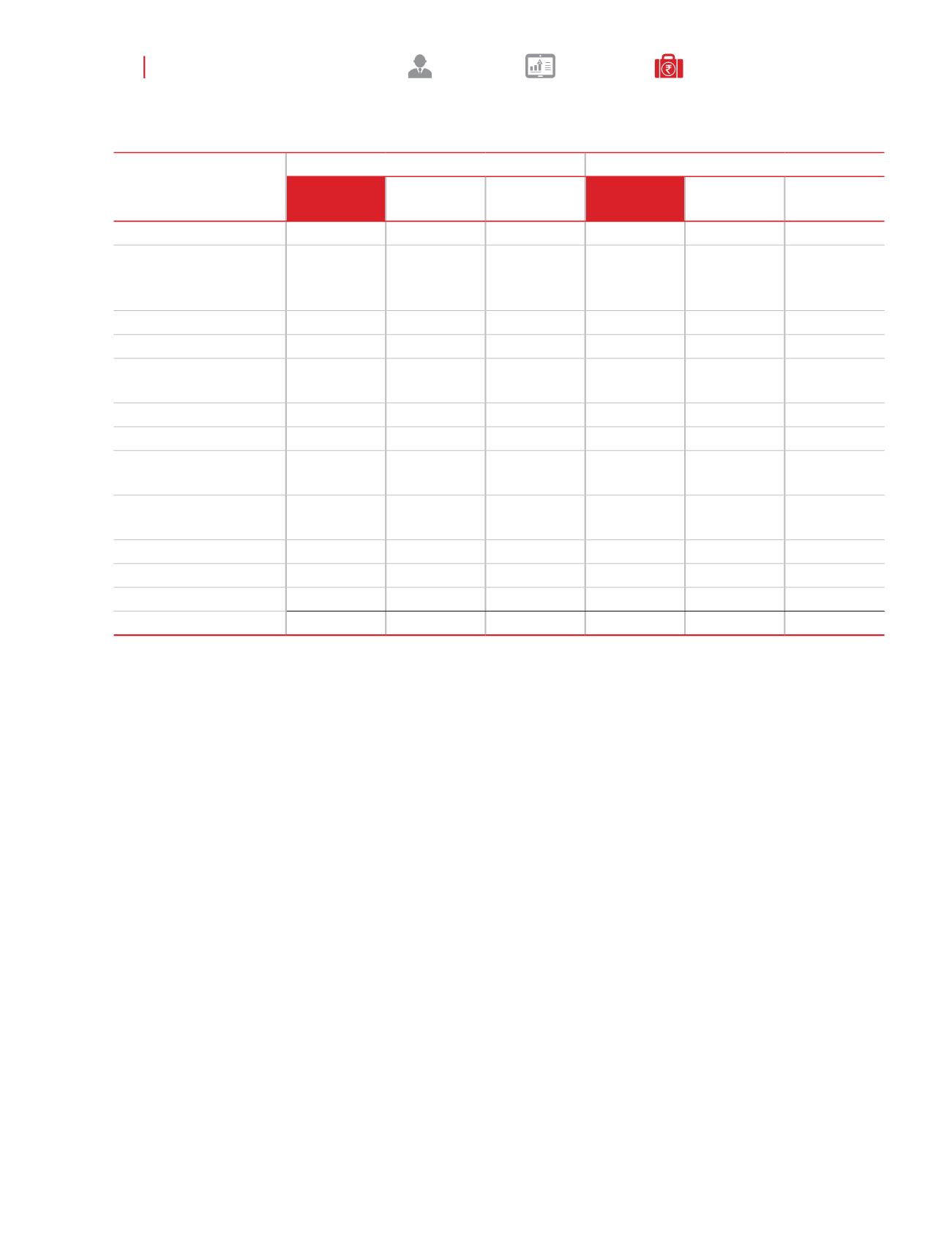

`

in crores)

Carrying value

Fair value

As at

31- Mar- 2017

As at

31-Mar-2016

As at

1-Apr-2015

As at

31- Mar- 2017

As at

31-Mar-2016

As at

1-Apr-2015

Financial liabilities

Financial liabilities

measured at amortised

cost

Long term borrowings

2.70

2.70

1.23

2.70

2.70

1.23

Short term borrowings

7.78

39.73

86.91

7.78

39.73

86.91

Current maturities of long

term debt

0.26

0.93

1.61

0.26

0.93

1.61

Trade payables

228.15

231.26

187.93

228.15

231.26

187.93

Security deposits received

11.49

5.18

3.72

11.49

5.18

3.72

Interest bearing deposits

from customers

9.03

11.09

7.16

9.03

11.09

7.16

Creditors for capital

expenditures

24.74

27.36

6.68

24.74

27.36

6.68

Creditors for expenses

0.45

1.37

1.76

0.45

1.37

1.76

Oustanding liabilities

17.55

18.65

14.50

17.55

18.65

14.50

Other payables

1.51

1.23

0.94

1.51

1.23

0.94

Total

303.66

339.50

312.43

303.66

339.50

312.44

39. Fair values

(contd...)

The management assessed that fair value of short term financial assets and liabilities significantly approximate their carrying

amounts largely due to the short term maturities of these instruments. The fair value of the financial assets and liabilities is

included at the amount at which the instrument could be exchanged in a current transaction between willing parties, other

than in a forced or liquidation sale.

The Company determines fair values of fianncial assets or liabilities by discounting the contractual cash inflows / outflows

using prevailing interest rates of financial instruments with similar terms. The initial measurement of financial assets and

financial liabilities is at fair value. The fair value of investments in mutual funds is determined using quoted net assets value

of the funds. Further, the subsequent measurements of all assets and liabilities (other then investments in mutual funds) is

at amortised cost, using effective interest rate method.

The following methods and assumptions were used to estimate the fair values:

- The fair value of the Company’s interest bearings borrowings are determined using discount rate that reflects the entity’s

discount rate at the end of the reporting period. The own non-performance risk as at the reporting period is assessed to

be insignificant.

- The fair value of unquoted instruments and other financial assets and liabilities is estimated by discounting future cash

flows using rates using rates currently applicable for debt on similar terms, credit risk and remaining maturities.

Notes on the standalone financial statements

for the year ended 31 March 2017