219

annual

report

20

16-17

kajaria

ceramics

corporate

overview

management

reports

Financial

statements

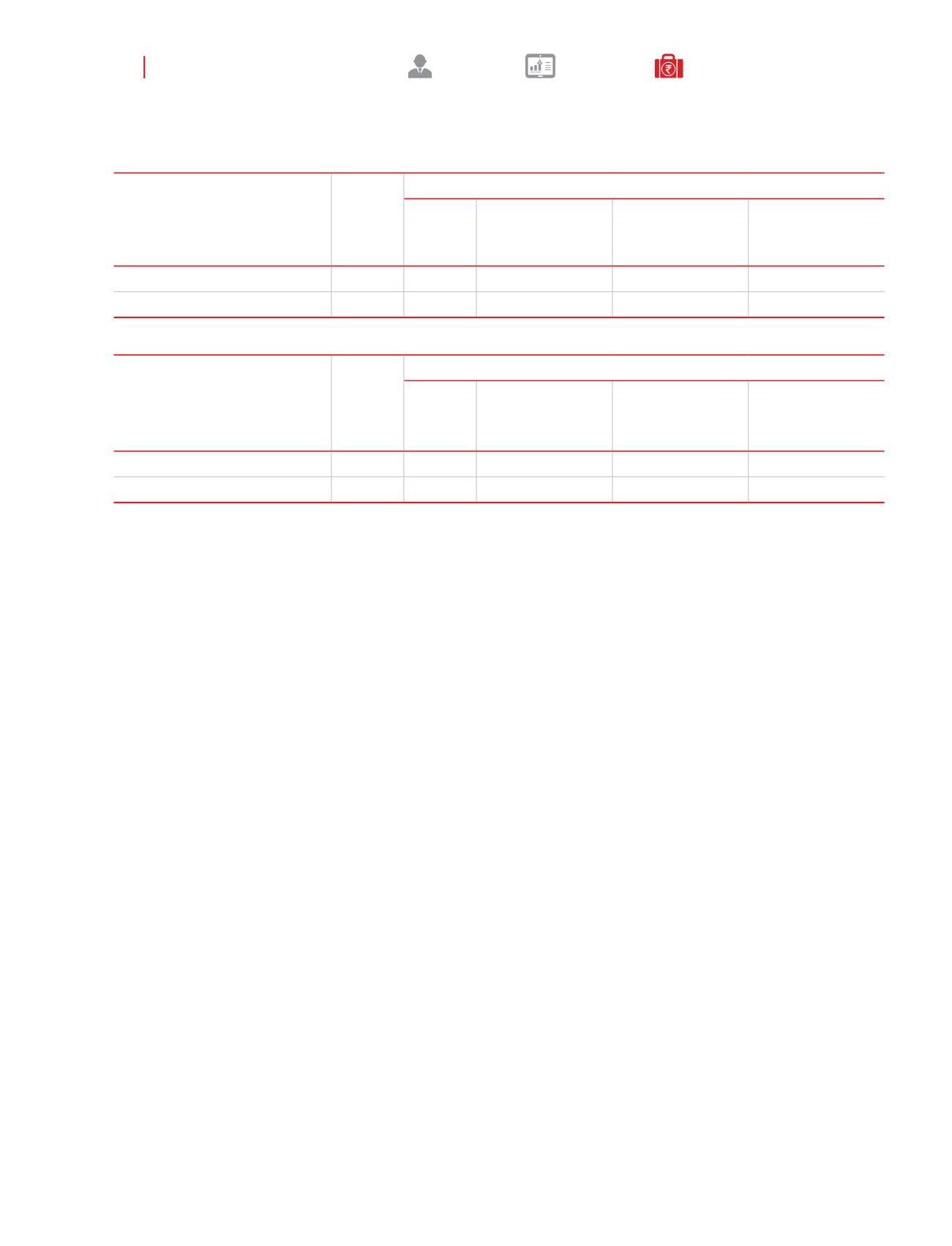

41. Fair value hierarchy

(contd...)

(

`

in crores)

Date of

valuation

Fair value measurement using

Total

Quoted prices in

active markets

(Level 1)

Significant

observable inputs

(Level 2)

Significant

unobservable

inputs (Level 3)

Assets measured at fair value:

Security deposits

1-Apr-15 6.56

-

-

6.56

Quantitative disclosures fair value measurement hierarchy for assets as at 1 April 2015:

(

`

in crores)

Date of

valuation

Fair value measurement using

Total

Quoted prices in

active markets

(Level 1)

Significant

observable inputs

(Level 2)

Significant

unobservable

inputs (Level 3)

Liabilities measured at fair value:

Borrowings

1-Apr-15

-

-

-

-

Quantitative disclosures fair value measurement hierarchy for liabilities as at 1 April 2015:

42. Financial risk management objectives and policies

The Company’s principal financial liabilities, other than derivatives, comprise , trade and other payables, security deposits,

employee liabilities. The Company’s principal financial assets include trade and other receivables, inventories and cash and short-

term deposits/ loan that derive directly from its operations.

The Company is exposed to market risk, credit risk and liquidity risk. The Company’s management oversees the management of

these risks. The Company’s senior management is supported by a Risk Management Compliance Board that advises on financial

risks and the appropriate financial risk governance framework for the Company. The financial risk committee provides assurance

to the Company’s management that the Company’s financial risk activities are governed by appropriate policies and procedures

and that financial risks are identified, measured and managed in accordance with the Company’s policies and risk objectives.

The management reviews and agrees policies for managing each of these risks, which are summarised below.

I. Market risk

Market risk is the risk that the fair value of future cash flows of a financial instrument will fluctuate because of changes

in market prices. Market risk comprises three types of risk: interest rate risk, currency risk and other price risk. Financial

instruments affected by market risk include , deposits.

The sensitivity analyses of the above mentioned risk in the following sections relate to the position as at 31 March 2017

and 31 March 2016.

The analyses exclude the impact of movements in market variables on: the carrying values of gratuity and other post-

retirement obligations; provisions; and the non-financial assets and liabilities of foreign operations. The analysis for the

contingent consideration liability is provided in Note 34.

The following assumptions have been made in calculating the sensitivity analyses:

- The sensitivity of the relevant profit or loss item is the effect of the assumed changes in respective market risks. This is

based on the financial assets and financial liabilities held at 31 March 2017 and 31 March 2016.

Notes on the consolidated financial statements

for the year ended 31 March 2017