215

annual

report

20

16-17

kajaria

ceramics

corporate

overview

management

reports

Financial

statements

37 Segment information

The business activity of the company falls within one broad business segment viz. “Ceramic/ Vitrified Tiles” and substantially

sale of the product is within the country. The Gross income and profit from the other segment is below the norms prescribed

in Ind AS 108 of The Institute of Chartered Accountants of India. Hence the disclosure requirement of Ind AS 108 of

“Segment Reporting” issued by the Institute of Chartered Accountants of India is not considered applicable.

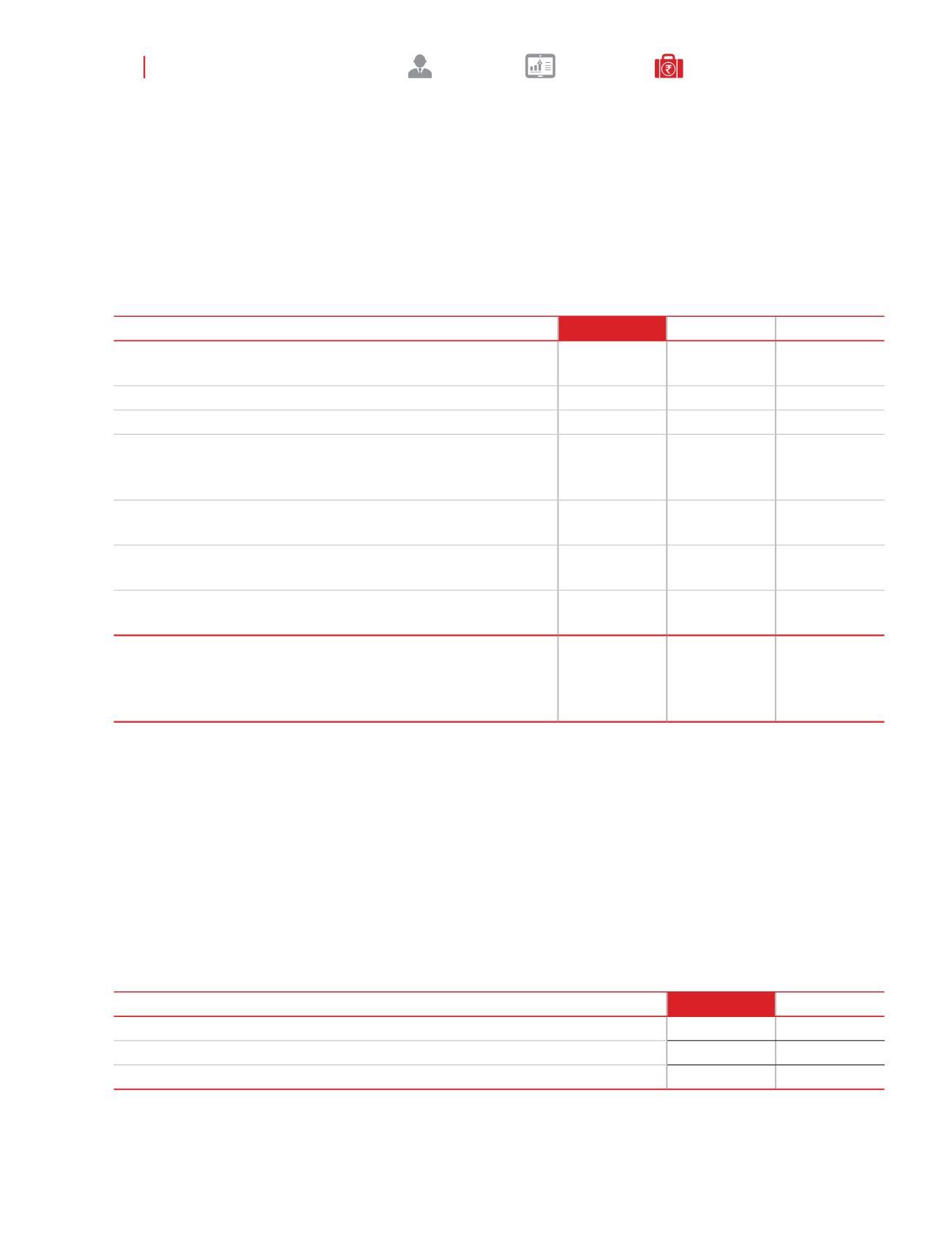

38. Dues to Micro and Small Enterprises

(

`

in crores)

Particulars

31 March 2017

31 March 2016 1 April 2015

The principal amount and the interest due thereon remaining unpaid to

any supplier as at the end of each accounting year

Principal amount due to micro and small enterprises

15.28

10.40

11.01

Interest due on above

-

-

-

The amount of interest paid by the buyer in terms of section 16 of the

MSMED Act 2006 along with the amounts of the payment made to the

supplier beyond the appointed day during each accounting year

-

-

-

"The amount of interest due and payable for the period of delay in

making payment (which

-

-

-

have been paid but beyond the appointed day during the year) but

without adding the interest specified under the MSMED Act 2006."

-

-

-

The amount of interest accrued and remaining unpaid at the end of each

accounting year

-

-

-

The amount of further interest remaining due and payable even in the

succeeding years, until such date when the interest dues as above are

actually paid to the small enterprise for the purpose of disallowance as a

deductible expenditure under section 23 of the MSMED Act 2006

-

-

-

The dues to Micro & Small Enterprises as required under the Micro, Small and Medium Enterprises Development Act, 2006 to

the extent information available with the company is given below:

39. Share Based Payments

Description of share based payments arrangements

During the year, the Company granted stock options to certain employees of the Company and its subsidiaries. The Company

has the following share-based payment arrangements for employees.

Kajaria Ceramics Employee Stock Option Plan 2015 (ESOP 2015)

The ESOP 2015 (“the Plan”) was approved by the Board of Directors and the shareholders on 7th September 2015. The plan

entitles employees of the Company and its subsidiaries to purchase shares in the Company at the stipulated exercise price,

subject to compliance with vesting conditions. Stock options will be settled by issue of equity shares. As per the Plan, holders

of vested options are entitled to purchase one equity share for every option at an exercise price of

`

850, which is 7.42%

below the stock price i.e.

`

918.10 at the date of grant, i.e., 20th October, 2015.

(

`

in crores)

31 March 2017

31 March 2016

Expense arising from equity-settled share-based payment transactions

1.87

0.83

Expense arising from cash-settled share-based payment transactions

-

-

Total expense arising from share-based payment transactions

1.87

0.83

There were no cancellations or modifications to the awards in 31 March 2017 or 31 March 2016.

The expense recognised for employee services received during the year is shown in the following table:

Notes on the consolidated financial statements

for the year ended 31 March 2017