224

Notes on the consolidated financial statements

for the year ended 31 March 2017

50 First time adoption of Ind AS

“These financial statements, for the year ended 31 March 2017, are the first the Company has prepared in accordance with

Ind AS. For periods up to and including the year ended 31 March 2016, the Company prepared its financial statements in

accordance with accounting standards notified under section 133 of the Companies Act 2013, read together with paragraph

7 of the Companies (Accounts) Rules, 2014 (Previous GAAP).

Accordingly, the Company has prepared financial statements which comply with Ind AS applicable for periods ending on 31

March 2017, together with the comparative period data as at and for the year ended 31 March 2016, as described in the

summary of significant accounting policies. In preparing these financial statements, the Company’s opening balance sheet was

prepared as at 1 April 2015, the Company’s date of transition to Ind AS. This note explains exemptions availed by the Company

in restating its Previous GAAP financial statements, including the balance sheet as at 1 April 2015 and the financial statements

as at and for the year ended 31 March 2016.

Exemptions applied:

1. Mandatory exceptions;

a) Estimates

The estimates at 1 April 2015 and at 31 March 2016 are consistent with those made for the same dates in accordance

with Previous GAAP (after adjustments to reflect any differences in accounting policies) apart from the following items

where application of Previous GAAP did not require estimation:

• Impairment of financial assets based on expected credit loss model

The estimates used by the Company to present these amounts in accordance with Ind AS reflect conditions at 1 April

2015, the date of transition to Ind AS and as of 31 March 2016.

b) De-recognition of financial assets:

The company has applied the de-recognition requirements in Ind AS 109 prospectively for transactions occurring on

or after the date of transition to Ind AS.

c) Classification and measurement of financial assets:

i. Financial Instruments:

Financial assets like security deposits received and security deposits paid, has been classified and measured at

amortised cost on the basis of the facts and circumstances that exist at the date of transition to Ind ASs. Since,

it is impracticable for the Company to apply retrospectively the effective interest method in Ind AS 109, the fair

value of the financial asset or the financial liability at the date of transition to Ind As by applying amortised cost

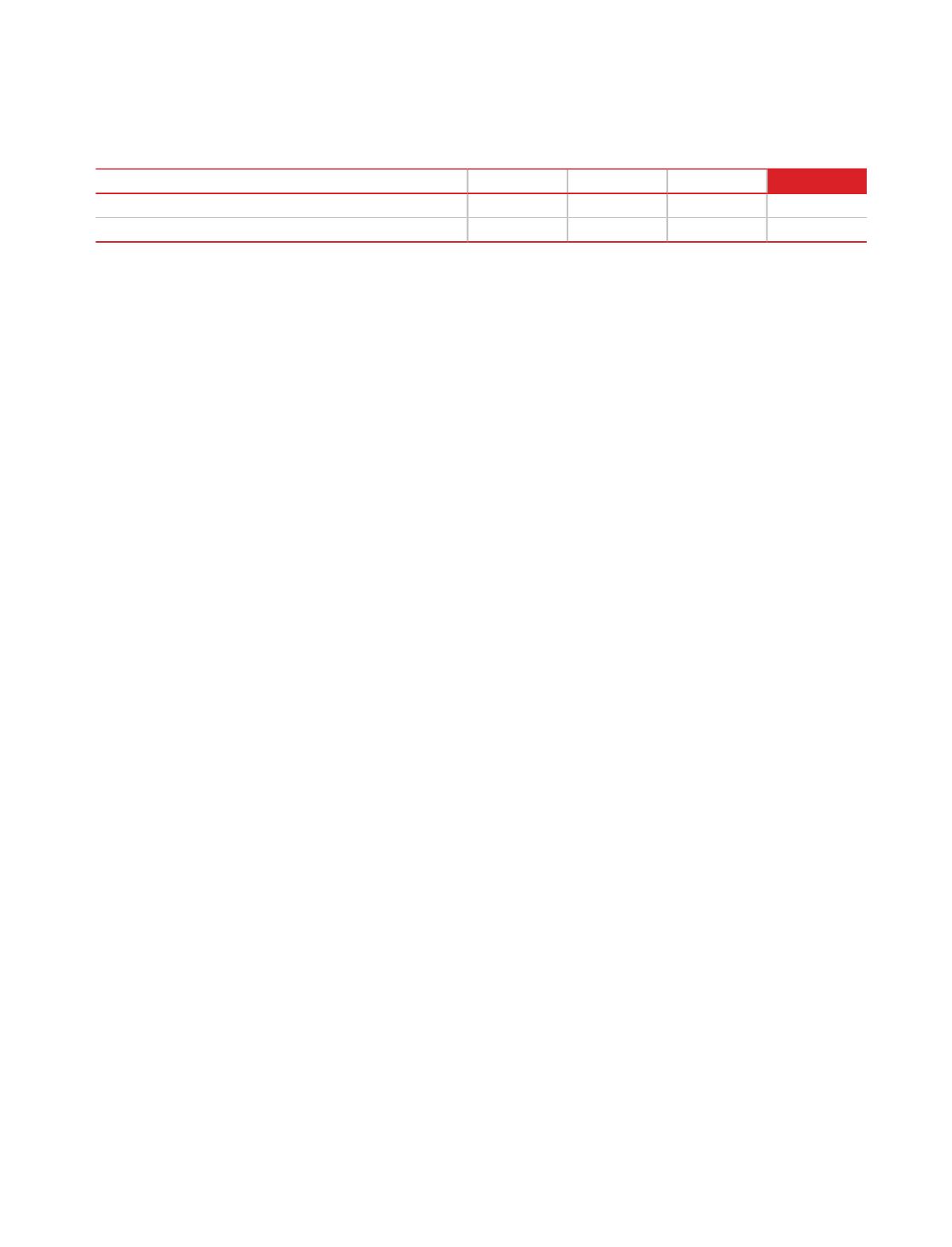

48 Research and development expenditure

Research and Development expenditure incurred from 2013-14 to 2016-17:

(

`

in crores)

Particulars

2013-14

2014-15

2015-16

2016-17

Capital expenditure

0.24

0.19

0.53

0.09

Revenue expenditure

4.66

6.28

8.13

10.92

49.

During the year, the Board of Directors of Kajaria Ceramics Limited (the Company) has approved Scheme of Arrangement,

which provides for, inter-alia, the amalgamation of a promoter company i.e. Kajaria Securities Private Limited with the

Company with appointed date as closing hours of business on March 31, 2017 (“Scheme”). The Company has filed the

Scheme for approval under sections 230-232 and 66 read with other applicable provisions of the Companies Act, 2013

and the Companies (Compromises, Arrangements and Amalgamations) Rules, 2016 before the Chandigarh Bench of the

National Company Law Tribunal (“NCLT”) vide application dated March 16, 2017. Pending approval of the Scheme by NCLT,

the management has not given effect to provisions of the proposed Scheme.