153

annual

report

20

16-17

kajaria

ceramics

corporate

overview

management

reports

Financial

statements

(

`

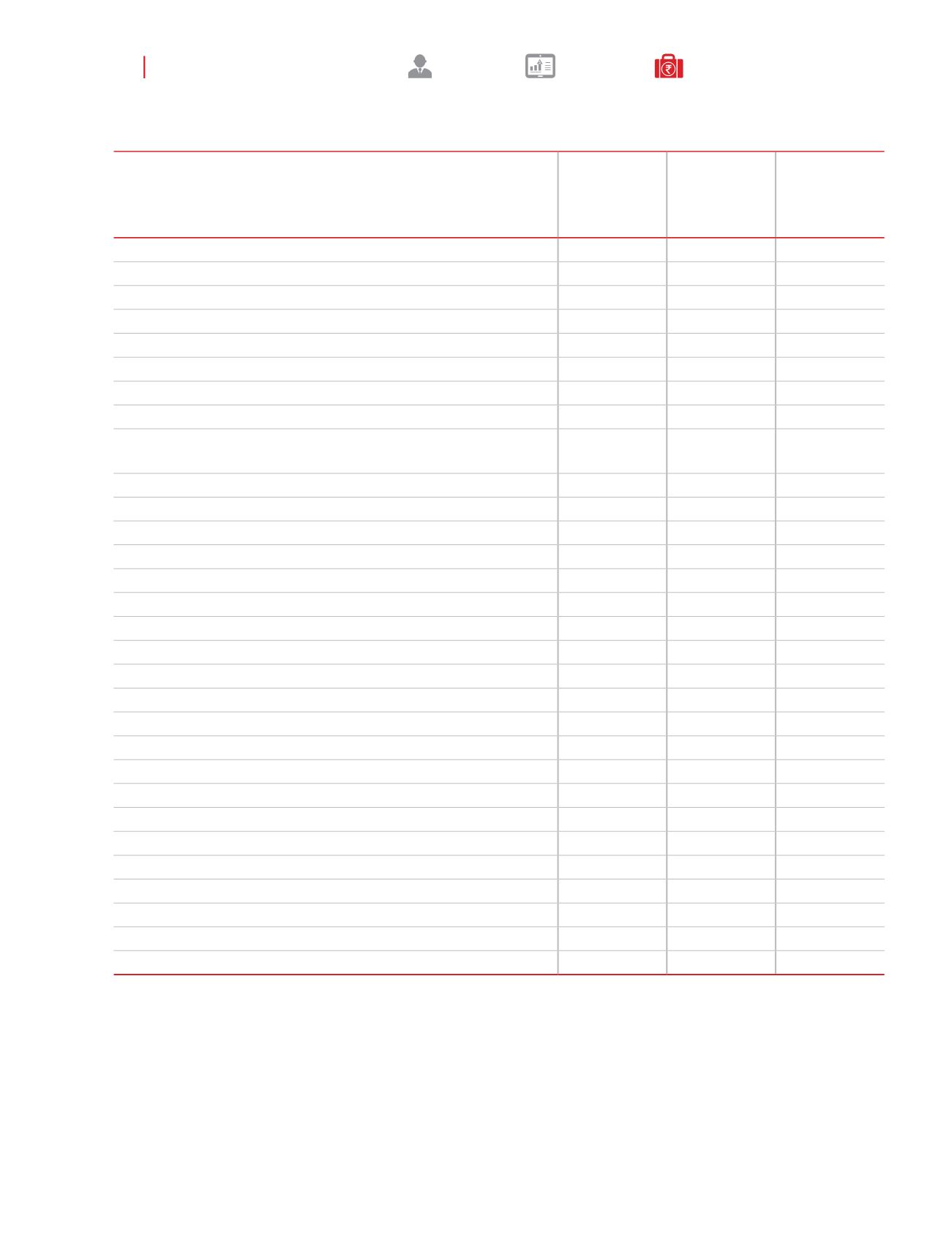

in crores)

Particulars

Indian GAAP

Year ended

31-Mar-16

GAAP

adjustments

Year ended

31-Mar-16

Ind AS

Year ended

31-Mar-16

Continuining Operations

Revenue from operations

2,443.02

166.41

2,609.43

Other Income

22.63

3.19

25.82

Total Revenue

2,465.65

169.60

2,635.25

EXPENSES

(a) Cost of materials consumed

345.04

-

345.04

(b) Purchases of finished, semi-finished and other products

1,035.77

-

1,035.77

(c) Changes in stock of finished goods, work-in-progress and stock-in-

trade

(8.99)

-

(8.99)

(d) Excise duty on sale of goods

-

166.41

166.41

(e) Employee benefit expense

190.04

(0.35)

189.69

(f) Finance costs

6.72

0.00

6.72

(g) Depreciation and amortisation expense

47.20

-

47.20

(h) Other expenses

496.93

0.46

497.39

Total Expenses

2,112.71

166.52

2,279.23

Profit/(loss) before exceptional items and tax

352.94

3.08

356.02

Exceptional Items

1.51

1.51

Profit/(loss) before and tax from continuing operations

351.43

3.08

354.51

Tax Expense

Current tax

105.00

-

105.00

Adjustment of tax relating to earlier periods

(0.12)

-

(0.12)

Deferred tax

11.66

0.97

12.63

Total tax expense

116.54

0.97

117.51

Profit/(loss) after tax from continuing operations

234.89

2.11

237.00

Profit/(loss) for the period

234.89

2.11

237.00

Other comprehensive income

-

(0.67)

(0.67)

Items that will not be recycled to profit & loss

Remeasurements of the defined benefit liabilities / (asset)

(1.02)

(1.02)

Income tax relating to items that will not be reclassified to profit & loss

-

0.35

0.35

Total comprehensive income for the period

234.89

1.44

236.33

51 Reconciliation of profit or loss for the year ended 31 March 2016

(contd...)

Footnotes to the reconciliation of equity as at 1 April 2015 and 31 March 2016 and profit & loss for the year ended 31

March 2016

1 Security deposits

Under Previous GAAP, the security deposits paid for lease rent are shown at the transaction value whereas under Ind

AS, the same are initially discounted and subsequently recorded at amortized cost at the end of every financial reporting

period. Accordingly, the difference between the transaction and discounted value of the security deposits paid towards

lease rent is recognized as deferred lease expense and is amortized over the period of the lease term. Further, interest is

accreted on the present value of the security deposits paid for lease rent.

Notes on the standalone financial statements

for the year ended 31 March 2017