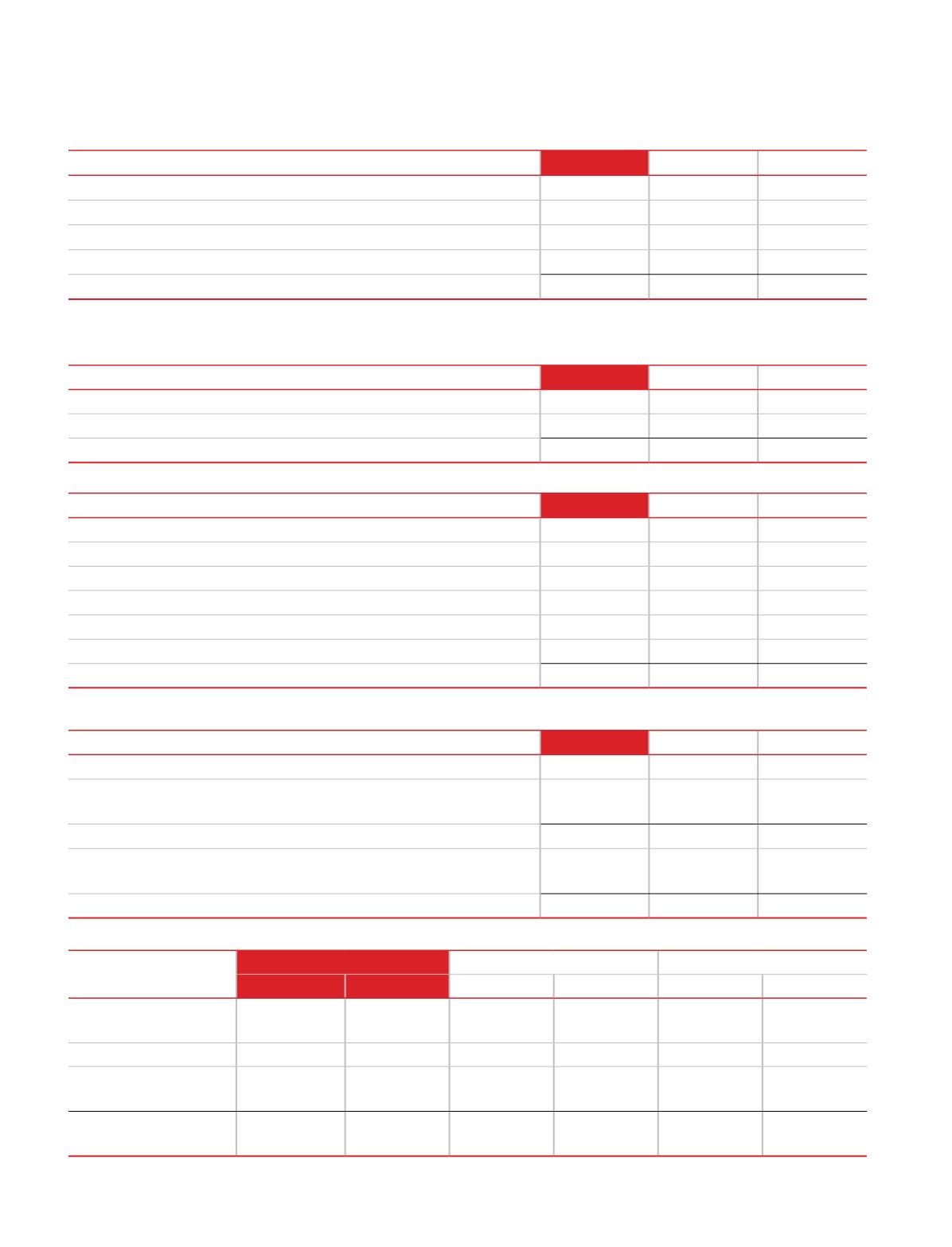

120

(

`

in crores)

31 March 2017

31 March 2016 1 April 2015

Loans to related parties *

Unsecured, Considered Good

7.07

0.06

54.21

Other loans

Unsecured, Considered Good

2.65

11.39

4.70

Total

9.72

11.45

58.91

* disclosure with respect to related party transactions is given in note 35.

11. Loans

(

`

in crores)

31 March 2017

31 March 2016 1 April 2015

Interest accrued on deposits and loans

1.26

0.24

4.06

Insurance claims receivables

0.22

0.36

0.20

Total

1.48

0.60

4.26

12. Other Financial assets

(

`

in crores)

31 March 2017

31 March 2016 1 April 2015

Break-up of the financial assets carried at amortised cost :

Security deposits

8.48

7.44

6.56

Loans to related parties

186.31

140.41

146.59

Trade receivables

305.90

252.20

199.89

Cash and bank balances

48.67

4.81

6.05

Other loans

2.65

11.39

4.70

Total

552.01

416.25

363.79

Loans are non-derivative financial assets which generates interest income at a fixed rate for the Company.

(

`

in crores)

31 March 2017

31 March 2016 1 April 2015

Authorised:

25,00,00,000 equity shares of Re 1 each (31 March 2016: 12,50,00,000, 1

April 2015: 12,50,00,000, equity shares of

`

2 each)

25.00

25.00

25.00

15,89,38,000 equity shares of

`

1 each (31 March 2016: 7,94,69,000, 1

April 2015: 7,94,69,000 equity shares of

`

2 each)

15.89

15.89

15.89

Total

15.89

15.89

15.89

13. Equity share capital

(

`

in crores)

31 March 2017

31 March 2016

1 April 2015

No of shares

Amount

No of shares

Amount

No of shares

Amount

At the beginning of the

year

79,469,000

15.89

79,469,000

15.89

79,469,000

15.89

Issued during the year

-

-

-

-

-

Share spilt during the year

(refer note 'C' below)

79,469,000

Outstanding at the end

of the year

158,938,000

15.89

79,469,000

15.89

79,469,000

15.89

A. Reconciliation of the shares outstanding at the beginning and at the end of the year

Notes on the standalone financial statements

for the year ended 31 March 2017