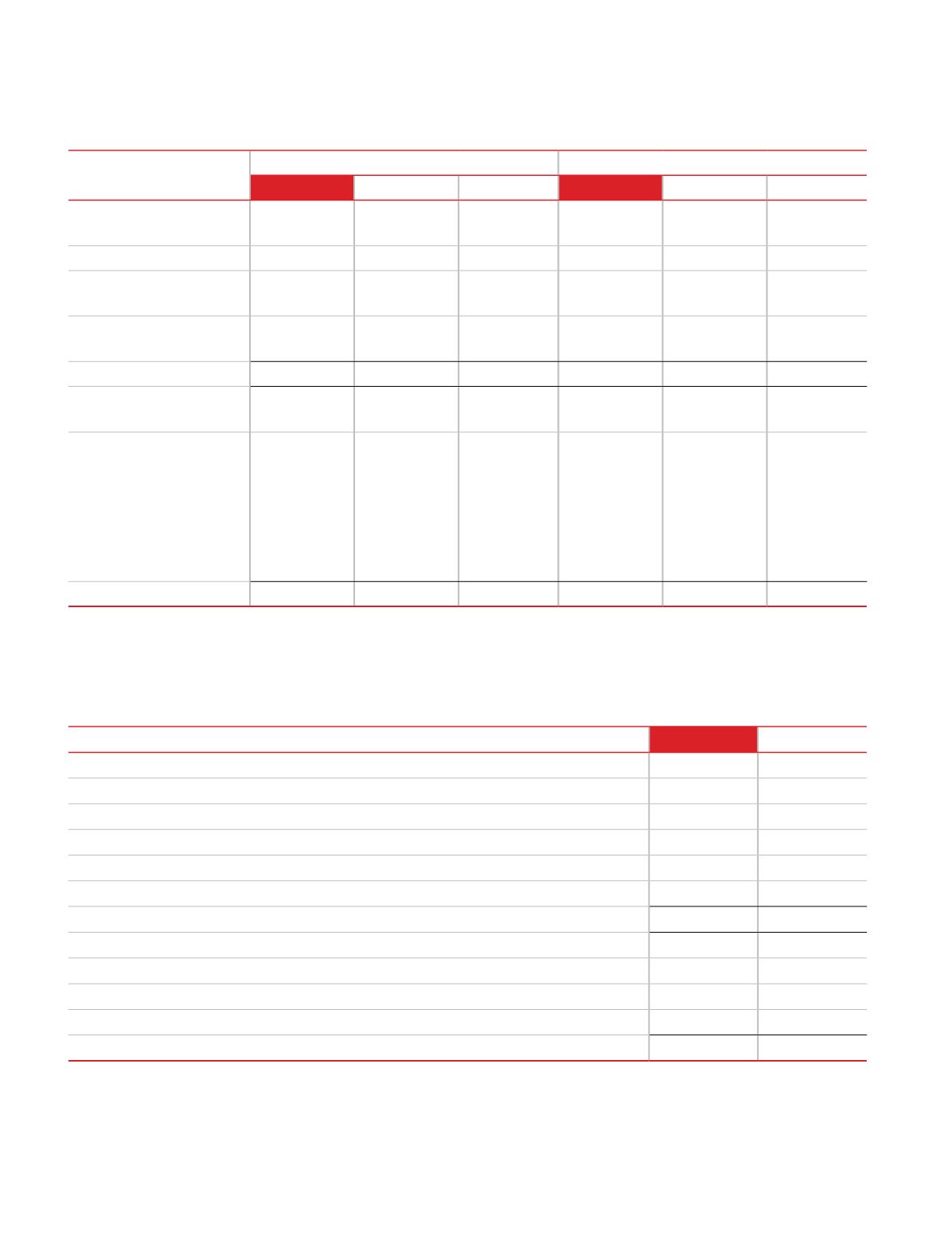

124

(

`

in crores)

Non-Current

Current

31 March 2017

31 March 2016 1 April 2015

31 March 2017

31 March 2016 1 April 2015

a. Provision for employee

benefits

Provision for gratuity

9.95

9.31

9.72

0.67

0.67

0.36

Provision for compensated

absences

-

-

-

9.34

8.00

7.39

(Refer note 33 for Ind AS

19 disclosures)

9.95

9.31

9.72

10.01

8.67

7.75

b. Current tax liabilities

(net)

Provision for Tax (Net of

advance tax & TDS)

(Advance tax and TDS-

31 March 2017: 114.98

crores, 31 March 2016:

93.30 crores, 1 April 2015:

69.77 crores)

-

-

-

7.12

11.69

2.22

Total

-

-

-

7.12

11.69

2.22

16. Provisions

(

`

in crores)

31 March 2017

31 March 2016

(i) Profit & loss section

Current income tax charge

122.10

105.00

Adjustments in respect of current income tax of previous year

0.07

(0.12)

Deferred tax:

Relating to origination and reversal of temporary differences

14.93

12.63

Income tax expense reported in the statement of Profit & loss

137.10

117.51

(ii) OCI Section

Deferred tax related to items recognised in OCI during the year:

Net loss/(gain) on remeasurements of defined benefit plans

0.36

0.35

Income tax charged to OCI

0.36

0.35

The major components of income tax expense for the year ended 31 March 2017 and 31 March 2016 are:

A. Statement of profit and loss:

17. Income Taxes

Notes on the standalone financial statements

for the year ended 31 March 2017