125

annual

report

20

16-17

kajaria

ceramics

corporate

overview

management

reports

Financial

statements

(

`

in crores)

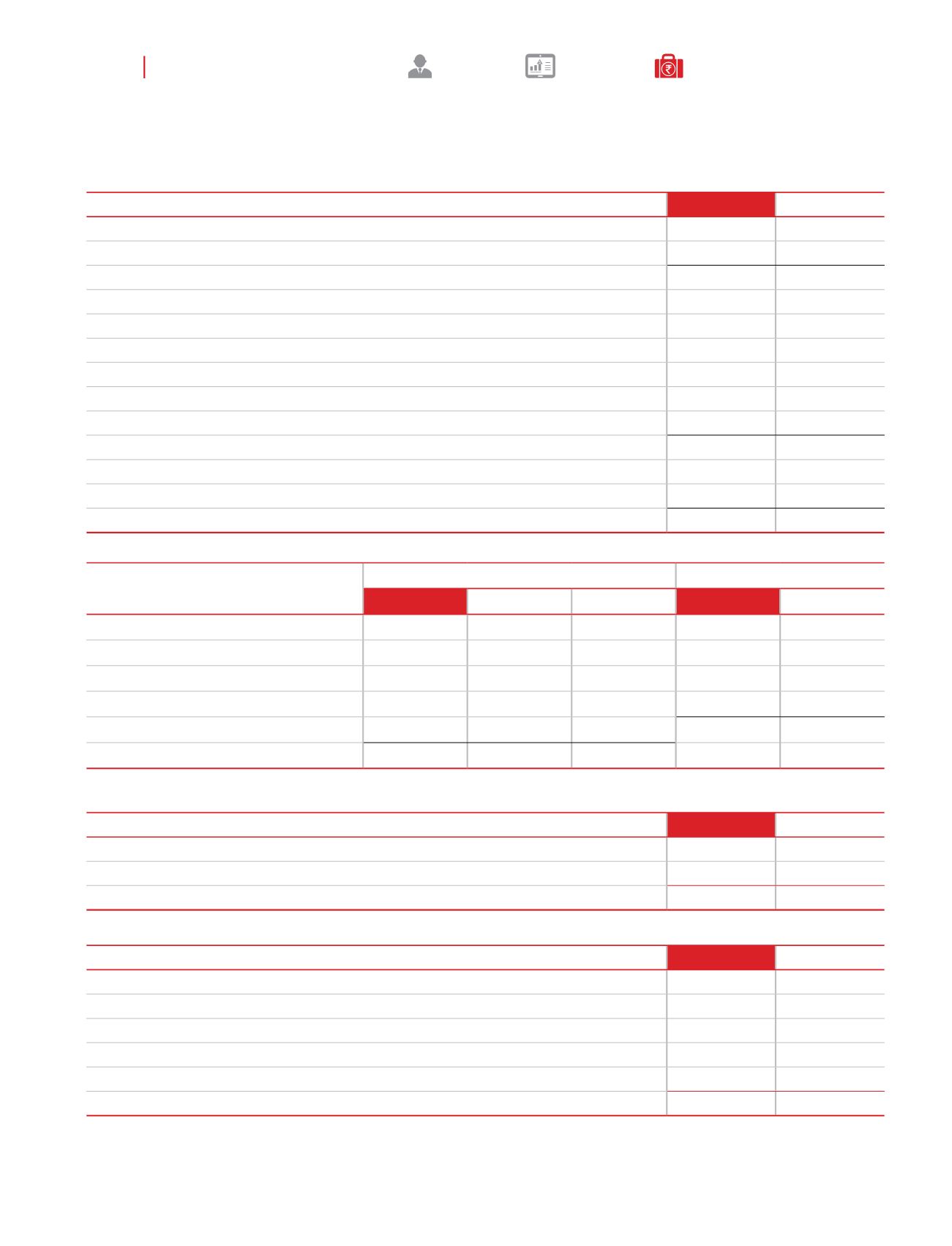

Balance sheet

Statement of profit and loss

31 March 2017

31 March 2016 1 April 2015

31 March 2017

31 March 2016

Deferred tax relates to the following:

Accelerated depreciation for tax purposes

102.41

86.80

75.16

15.98

11.99

Disallowance u/s 43B

(3.23)

(2.77)

(2.79)

(0.47)

0.02

Ind AS adjustments

(0.10)

0.48

(0.14)

(0.58)

0.62

Deferred tax expense/(income)

14.93

12.63

Net deferred tax assets/(liabilities)

99.08

84.51

72.23

Deferred tax

17. Income Taxes

(contd...)

(

`

in crores)

31 March 2017

31 March 2016

Accounting profit before tax from continuing operations

407.26

354.51

Profit/(loss) before tax from a discontinued operation

-

-

Accounting profit before income tax

407.26

354.51

At India’s statutory income tax rate of 34.608% (31 March 2016: 34.608%)

140.94

122.69

Adjustments in respect of current income tax of previous years

0.07

(0.12)

Expenses not allowed as deduction

1.18

1.24

Deductions not leading to timing differences

(4.77)

(7.56)

Exempt income

(0.32)

-

Impact of change in effective tax rate in B/F tax liability

-

1.26

At the effective income tax rate of 33.66% (31 March 2016: 33.15%)

137.10

117.51

Income tax expense reported in the statement of profit and loss

137.10

117.51

Income tax attributable to a discontinued operation

-

-

137.10

117.51

B. Reconciliation of tax expense and the accounting profit multiplied by India’s domestic tax rate for FY ended 31 March

2016 and 31 March 2017:

(

`

in crores)

31 March 2017

31 March 2016

Deferred tax assets (continuing operations)

(3.33)

(2.77)

Deferred tax liabilities (continuing operations)

102.41

87.28

Deferred tax liabilities, net

99.08

84.51

Reflected in the balance sheet as follows:

(

`

in crores)

31 March 2017

31 March 2016

Opening balance as of 1 April

84.51

72.23

Tax (income)/expense during the period recognised in Profit & loss

14.93

12.63

Tax (income)/expense during the period recognised in OCI

(0.35)

Discontinued operation

Deferred taxes acquired in business combinations

Closing balance as at 31 March

99.44

84.51

Reconciliation of deferred tax liabilities (net):

Notes on the standalone financial statements

for the year ended 31 March 2017