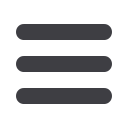

118

Notes on the standalone financial statements

for the year ended 31 March 2017

(

`

in crores)

Non Current

Current

31 March 2017

31 March 2016 1 April 2015

31 March 2017

31 March 2016 1 April 2015

Capital advances

Unsecured, considered

good

2.18

3.29

7.48

-

-

-

Other loans and advances

(Unsecured, considered

good)

Advance to suppliers

-

-

-

10.94

15.47

11.80

Prepaid expenses

-

-

-

3.69

2.25

1.31

Export benefit receivables

-

-

-

0.16

0.12

0.71

Income tax advances

0.13

0.40

0.03

-

-

-

Balance with statutory

authorities

CENVAT Credit Receivable

-

-

-

9.46

14.98

6.21

VAT Credit receivable

-

-

-

3.79

2.40

3.67

Service tax credit

receivable

-

-

-

5.35

4.96

2.86

Total

2.31

3.69

7.51

33.39

40.18

26.56

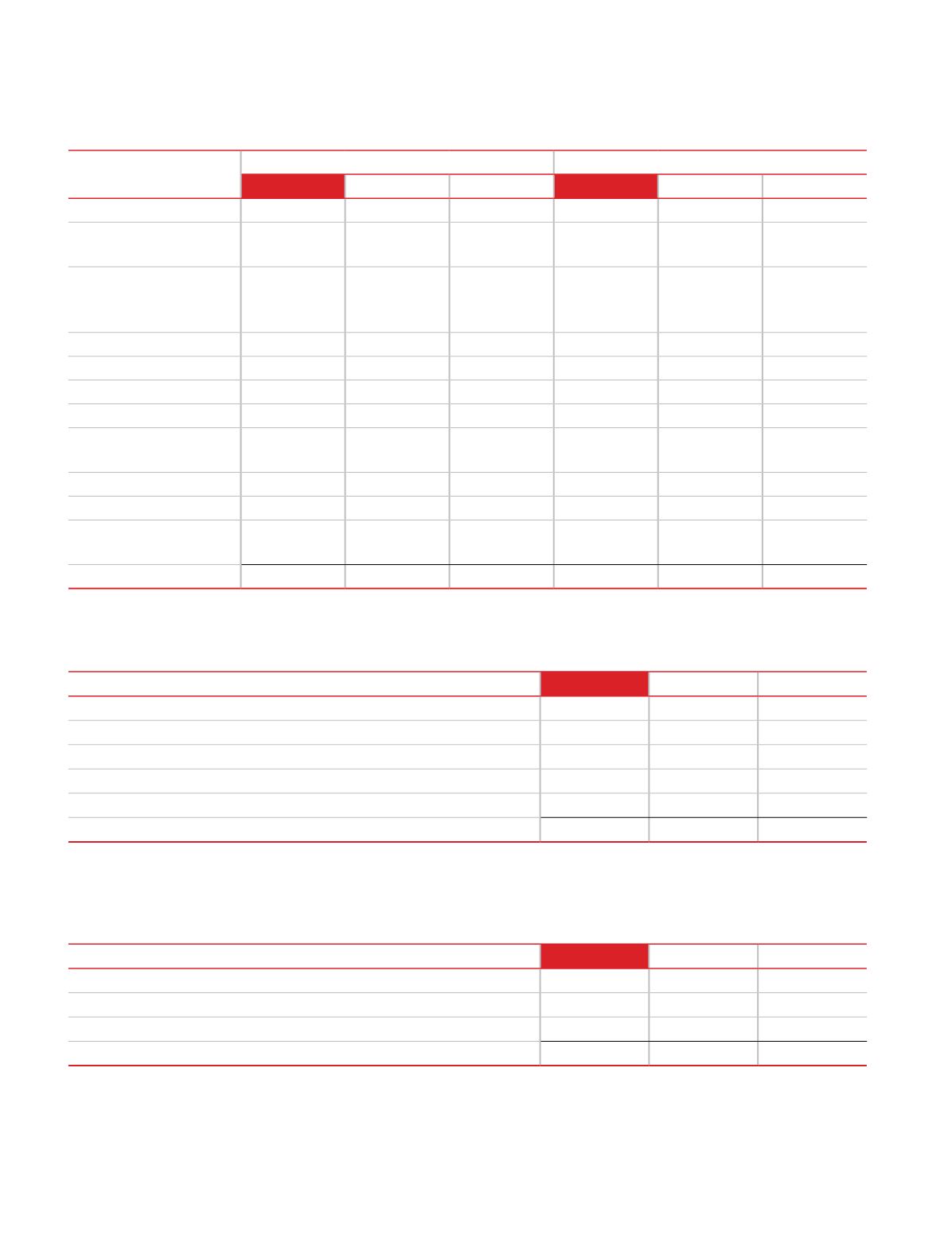

7. Other non-financial assets

(

`

in crores)

31 March 2017

31 March 2016 1 April 2015

Raw Materials

34.95

31.89

27.57

Work-in-progress

7.18

7.24

4.00

Finished Goods

143.70

129.14

126.26

Stock in trade

17.04

18.70

16.07

Stores and spares

31.79

33.02

28.03

Total

234.66

219.99

201.93

Note:

For mode of valuation refer Accounting policy number 2.2 (g)

8. Inventories

(

`

in crores)

31 March 2017

31 March 2016 1 April 2015

Considered good

303.66

250.79

198.09

Considered doubtful

3.53

2.36

2.19

Less: Provision for doubtful receivables

(1.29)

(0.95)

(0.39)

Total

305.90

252.20

199.89

Note:

No trade or other receivable are due from directors or other officers of the company either severally or jointly with any other person.

Nor any trade or other receivable are due from firms or private companies in which any director is a partner, director or a member.

Trade receivables are non interest bearing and are generally on credit terms of 30 days.

9. Trade receivables (unsecured)