Notes on

Accounts

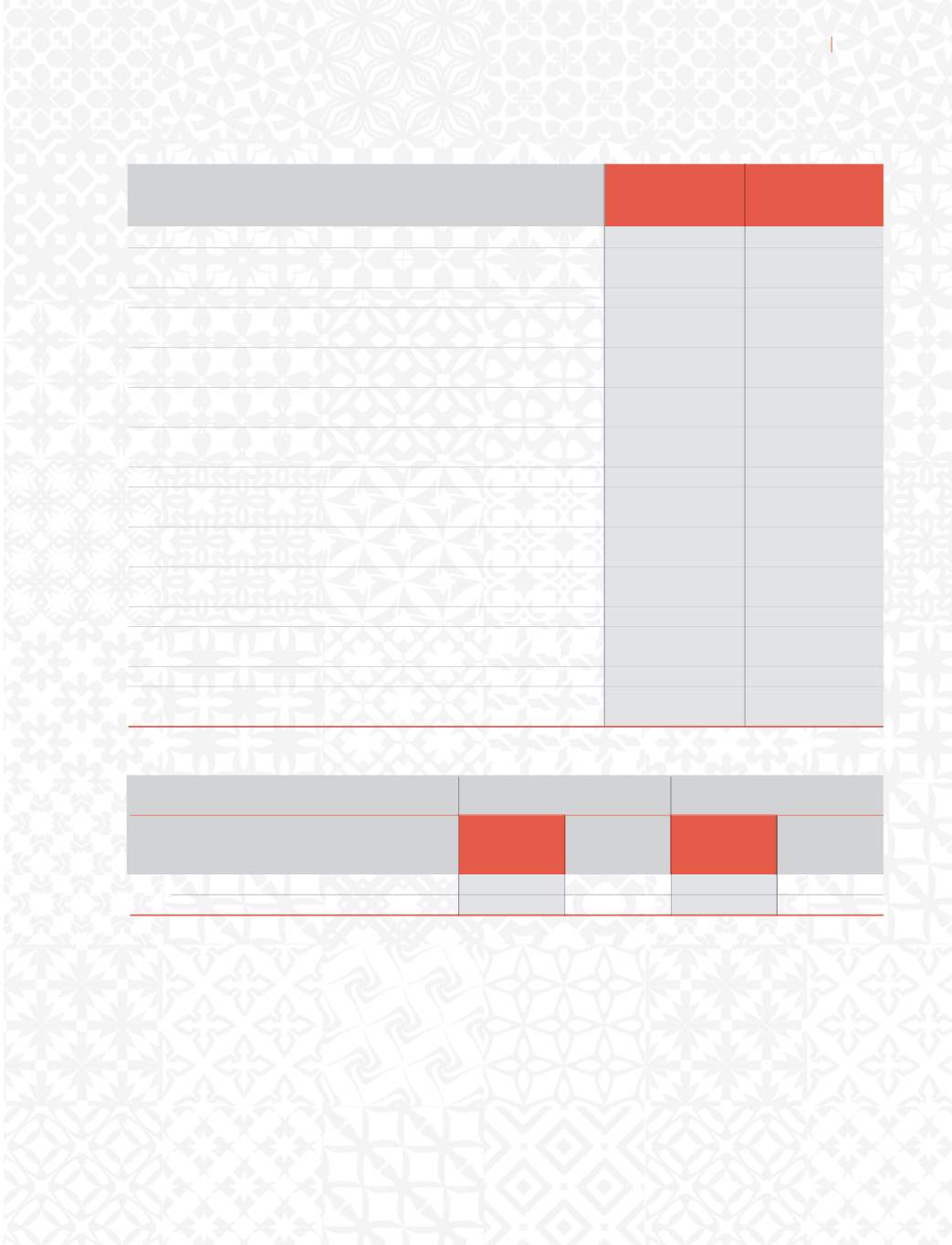

C. Outstanding balance and balance written off/written back:-

Description

Outstanding Balances

Written off/Written back

(

`

million)

(

`

million)

As At

As At

As At

As At

31st March,

31st March,

31st March,

31st March,

2014

2013

2014

2013

Key Management Personnel

–

–

–

–

Others

–

–

–

–

36. Segmental Reporting:

The business activity of the Company falls within one broad business segment viz “Ceramic Tiles” and substantially sale of the

QSPEVDU JT XJUIJO UIF DPVOUSZ 5IF (SPTT JODPNF BOE QSPmU GSPN UIF PUIFS TFHNFOU JT CFMPX UIF OPSNT QSFTDSJCFE JO "4 PG

The Institute of Chartered Accountants of India. Hence the disclosure requirement of Accounting Standard 17 of “Segment

Reporting” issued by the Institute of Chartered Accountants of India is not considered applicable.

37. Share Warrants:

The Company had, in its EOGM dated 6th November, 2013 approved the issuance of 3885420 warrants to M/s. WestBridge

Crossover Fund LLC and as per terms of issue, 25% of the total consideration, amounting to

`

250 million has been received

during the year. Each warrant is convertible into one equity share of

`

2/- each at a premium of

`

255.372433 per share as per SEBI

(ICDR) regulations, 2009 for Preferential issues, within one year from the date of allotment, i.e., 11th November, 2013.

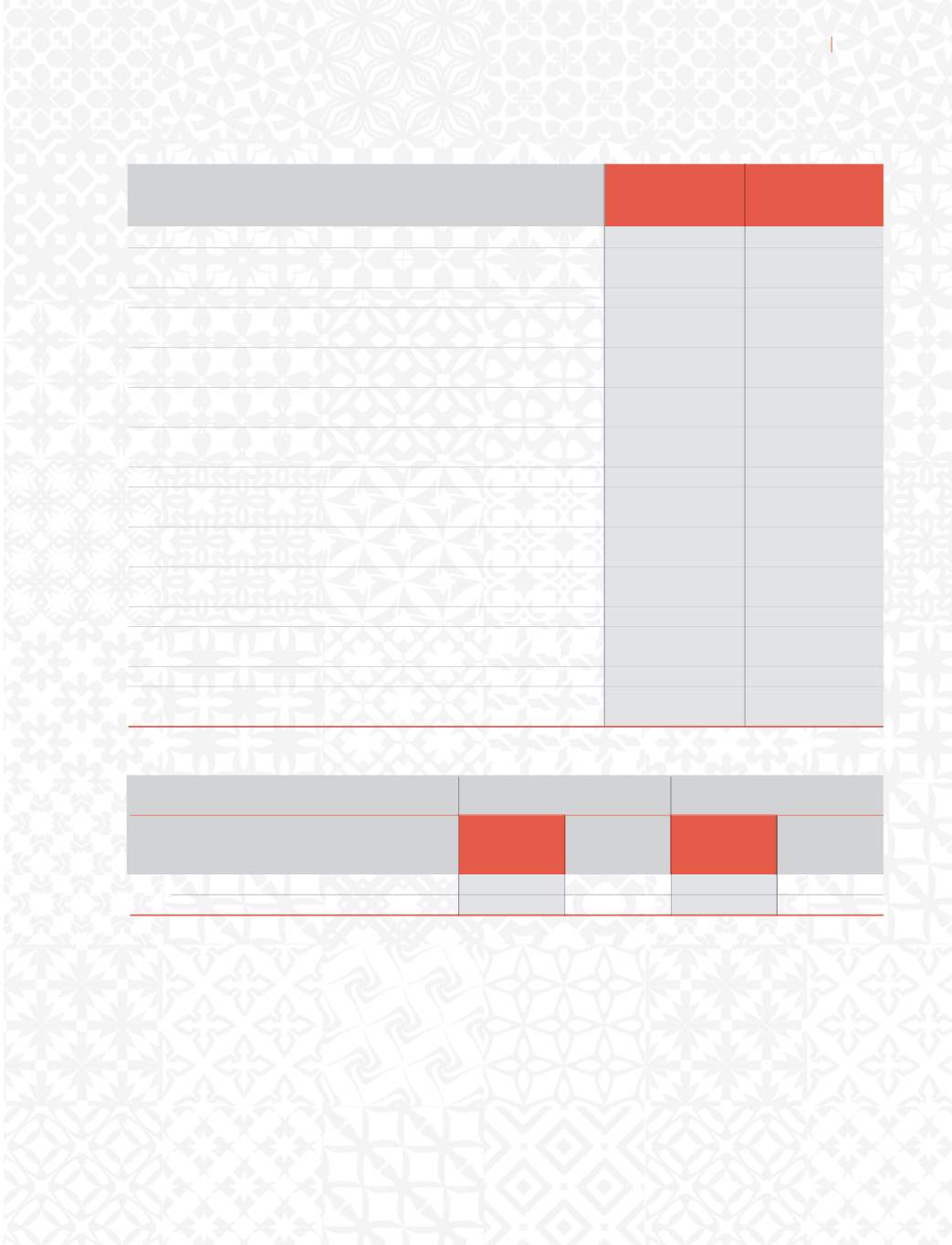

B. The following transactions were carried out with related parties in the ordinary course of business :-

Related Party Transactions

Key Management

Others

Personnel &

their relatives

Service Charges Paid

Dua Engineering Works Pvt. Ltd.

–

13.48

(–)

(10.79)

Directors’ Remuneration

Sh. Ashok Kajaria

25.89

–

(36.54)

(–)

Sh. Chetan Kajaria

39.40

–

(32.69)

(–)

Sh. Rishi Kajaria

39.40

–

(32.69)

(–)

Sh. B. K. Sinha

4.33

–

(3.94)

(–)

Purchase of shares of Subsidiary

Sh. Versha Devi Kajaria

0.01

(–)

(–)

(–)

Sh. Chetan Kajaria

0.01

–

(–)

(–)

Sh. Rishi Kajaria

0.01

–

(–)

(–)

Donation Paid

Malti Devi Kajaria Charitable Trust

–

4.25

(–)

(2.63)

Security Deposit received back

Dua Engineering Works Pvt. Ltd.

–

29.00

(–)

(–)

(

`

in million)

(Figures in brackets are for previous year)

91

Annual Report 2013-14