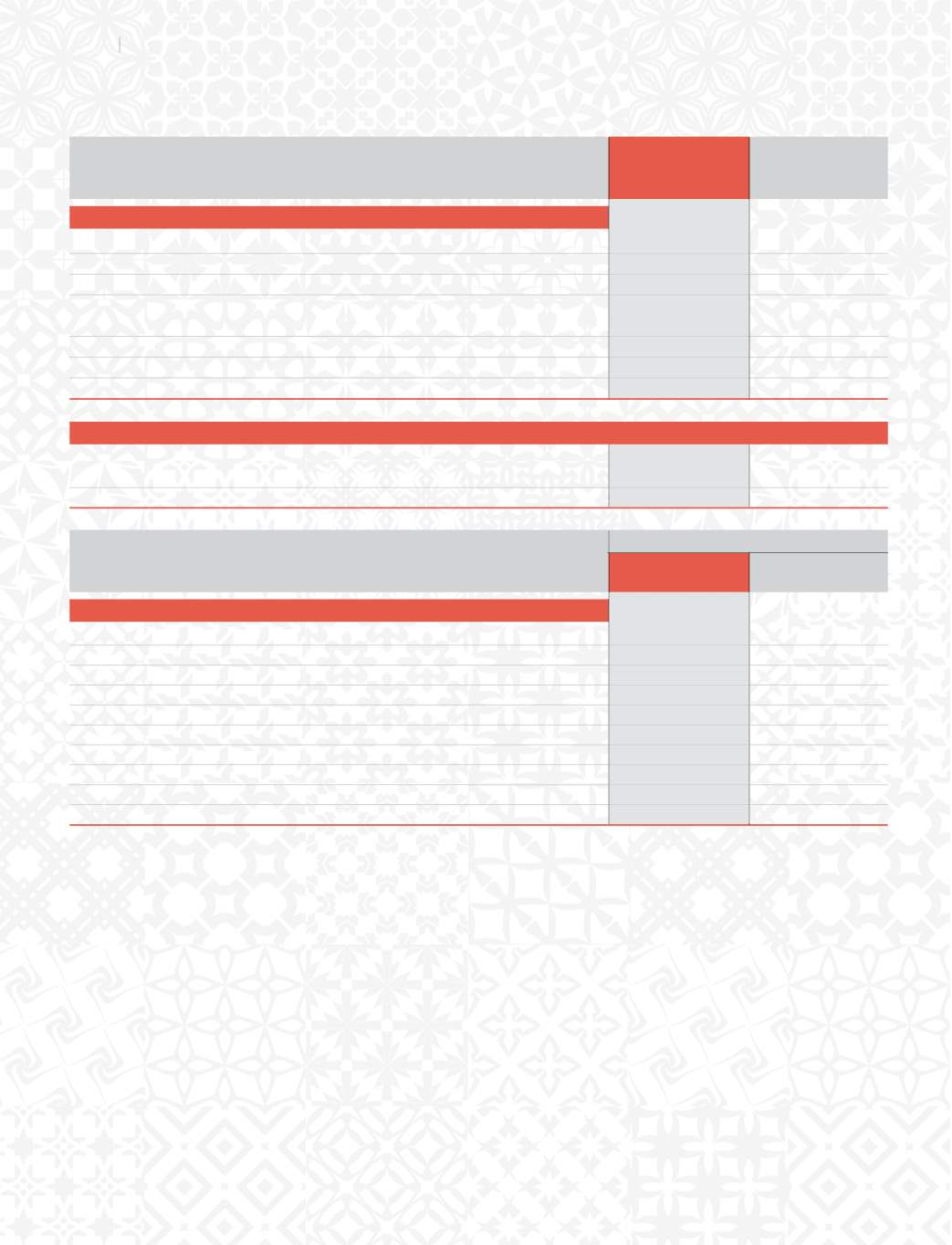

27. CONTINGENT LIABILITIES

As at

As at

31.03.2014

31.03.2013

`

in million

`

in million

FYDMVEJOH NBUUFST TFQBSBUFMZ EFBMU XJUI JO PUIFS OPUFT

a) In respect of bills discounted with the Company’s Bankers

37.86

73.72

b) Counter guarantees issued in respect of guarantees issued by Company’s bankers

56.00

Nil

D *O SFTQFDU PG &YDJTF %VUZ 4BMFT 5BY 4FSWJDF 5BY $VTUPN %VUZ %FNBOET QFOEJOH

before various authorities and in dispute

101.49

63.94

E *O SFTQFDU PG QFOEJOH JODPNF UBY EFNBOET

o

In respect of Consumer Cases

25.21

16.00

In respect of disputed Electricity Demand pending with appellate authorities.

–

9.41

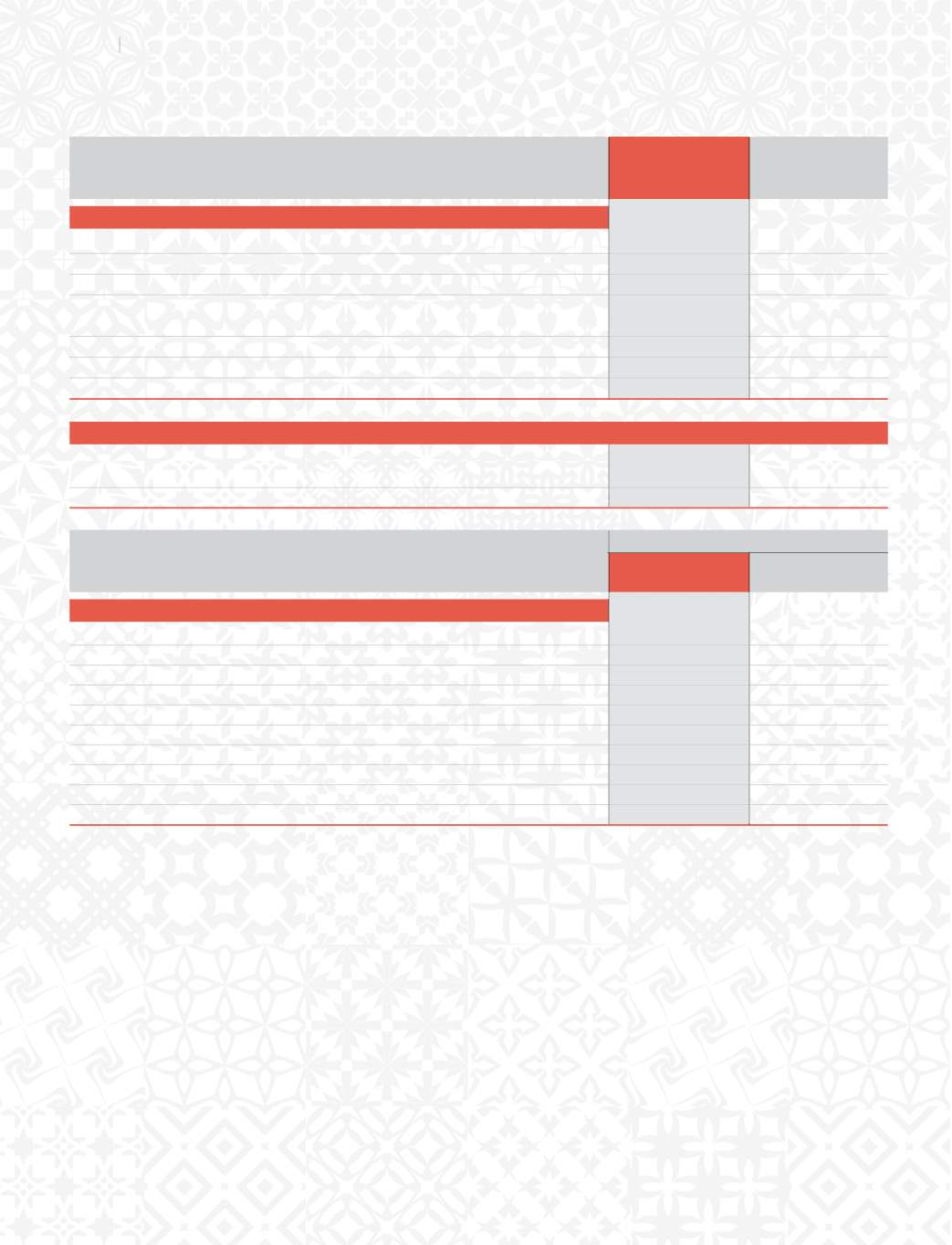

29. PARTICULARS OF SALES & STOCKS

Value

(

`

in million)

Year ended

Year ended

31.03.2014

31.03.2013

a) Opening Stock

Tiles

1445.18

1201.99

b) Purchases

Tiles

4,294.49

3973.45

c) Sales

Tiles (Manufactured)

16213.82

13206.77

Tiles (Trading)

4011.11

4111.68

Power

18.00

17.35

d) Closing Stock

Tiles

1095.90

1445.18

B &TUJNBUFE BNPVOU PG DPOUSBDUT SFNBJOJOH UP CF FYFDVUFE PO $BQJUBM "DDPVOU

and not provided for (Net of advances)

556.20

54.62

b) Letters of Credit opened in favour of inland/overseas suppliers (Net)

983.22

732.84

28. COMMITMENTS

Notes on

Accounts

30.

As per policy of the Company for Directors and other senior employees the Company has, during the year, paid a sum of

`

5

million on account of insurance premium under the employer employee policy obtained on the life of key directors and the same

lies debited under the head ‘Insurance Charges’. The policy may be assigned in the name of the insured in future. In such an

event of assignment of the policy, the same shall be treated as perquisite in the hands of the key personnel.

31.

#BMBODFT PG DFSUBJO EFCUPST DSFEJUPST MPBOT BOE BEWBODFT BSF TVCKFDU UP DPOmSNBUJPO

32.

In the opinion of the Management current assets, loans and advances have a value on realisation in the ordinary course of

CVTJOFTT BU MFBTU FRVBM UP UIF BNPVOU BU XIJDI UIFZ BSF TUBUFE FYDFQU XIFSF JOEJDBUFE PUIFSXJTF

33.

(SBUVJUZ BOE 0UIFS 1PTU &NQMPZNFOU #FOFmU 1MBOT

5IF $PNQBOZ IBT B EFmOFE CFOFmU HSBUVJUZ QMBO (SBUVJUZ CFJOH BENJOJTUFSFE CZ B 5SVTU JT DPNQVUFE BT EBZT TBMBSZ GPS

FWFSZ DPNQMFUFE ZFBS PG TFSWJDF PS QBSU UIFSFPG JO FYDFTT PG NPOUIT BOE JT QBZBCMF PO SFUJSFNFOU UFSNJOBUJPO SFTJHOBUJPO

5IF CFOFmU WFTUT PO UIF FNQMPZFF DPNQMFUJOH ZFBST PG TFSWJDF 5IF (SBUVJUZ QMBO GPS UIF $PNQBOZ JT B EFmOFE CFOFmU TDIFNF

XIFSF BOOVBM DPOUSJCVUJPOT BSF EFQPTJUFE UP B (SBUVJUZ 5SVTU 'VOE FTUBCMJTIFE UP QSPWJEF HSBUVJUZ CFOFmUT 5IF 5SVTU 'VOE IBT

taken a Scheme of Insurance, whereby these contributions are transferred to the insurer. The Company makes provision of such

gratuity asset/liability in the books of accounts on the basis of actuarial valuation as per the Projected unit credit method. Plan

assets also include investments and bank balances used to deposit premiums until due to the insurance company.

88

Kajaria Ceramics Limited