Mr. Ram Chandra Rawat, COO (A&T) & Company Secretary of

the Company acts as the Secretary of the Audit Committee. The

Chairman of the Audit Committee also attended the last Annual

General Meeting of the Company held on 24th August 2016.

Terms of Reference of Audit Committee

The Terms of reference of Audit Committee as per Provisions

of Companies Act 2013 read with Listing Regulations inter alia

includes the following:

a) Overseeing the Company’s financial reporting process and

disclosure of its financial information to ensure that the

financial statements are correct, sufficient and credible.

b) Recommending to the Board, the appointment/ re-

appointment, and if required, replacement or removal of

the statutory auditors, fixation of audit fee and approving

payments for any other service rendered by statutory

auditors.

c) Discussion with the statutory auditors about the nature and

scope of audit as well as post audit discussion to ascertain

areas of concern, if any.

d) Recommending to the Board of Directors, the appointment

/ re-appointment of Cost Auditor of the Company.

e) Reviewing with the management, annual financial

statements and auditors report thereon before submission

to the Board for approval, with particular reference to:

i. Matter required to be included in the Directors

Responsibility Statement to be included in the Board’s

Report in terms of Section 134 (3)(c) of the Companies

Act, 2013.

ii. Changes, if any, in accounting policies and practices and

reasons of the same.

iii. Major Accounting entries involving estimates based on

exercise of judgement by management.

iv. Significant adjustments made in financial statements

arising out of Audit.

v. Compliances with the listing and other legal

requirements relating to financial statements.

vi. Disclosure of Related Party Transactions.

vii. Qualification in draft audit report.

f) Reviewing with the management, the quarterly, half yearly

and annual financial statements before submission to the

Board.

g) Reviewing with the internal auditor and statutory auditors,

the adequacy of internal controls and steps taken for

strengthening the areas of weakness in internal controls.

h) Reviewing the adequacy of internal audit function in the

Company and discussing the findings and follow up with

the internal auditors.

i) Reviewing the findings of any internal investigations by

the internal auditors into matters where there is suspected

fraud or irregularity or failure of internal control systems of

a material nature and reporting the matter to the Board.

j) Evaluation of internal control and risk management system.

k) Reviewing with the management, the statements of uses/

application of funds raised through an issue.

l) Review and monitor the Auditor’s independence and

performance and effectiveness of audit process.

m) Approval or any subsequent modification of transaction of

the Company with related parties.

n) Review of inter-corporate loans and investments.

o) Looking into the reasons for substantial defaults, if any,

in the payment to the depositors, debenture holders,

shareholders (in case of non-payment of declared dividend)

and creditors.

p) Reviewing the management discussion and analysis of

financial condition and results of Operations.

q) Valuation of undertakings or assets of the Company,

whenever it is necessary.

r) Approval of appointment of CFO after assessing the

qualifications, experience and background etc. of the

candidate.

s) Reviewing the functioning of the Whistle Blower Mechanism.

t) Carrying out such other functions as mentioned in the terms

of reference to the Audit Committee.

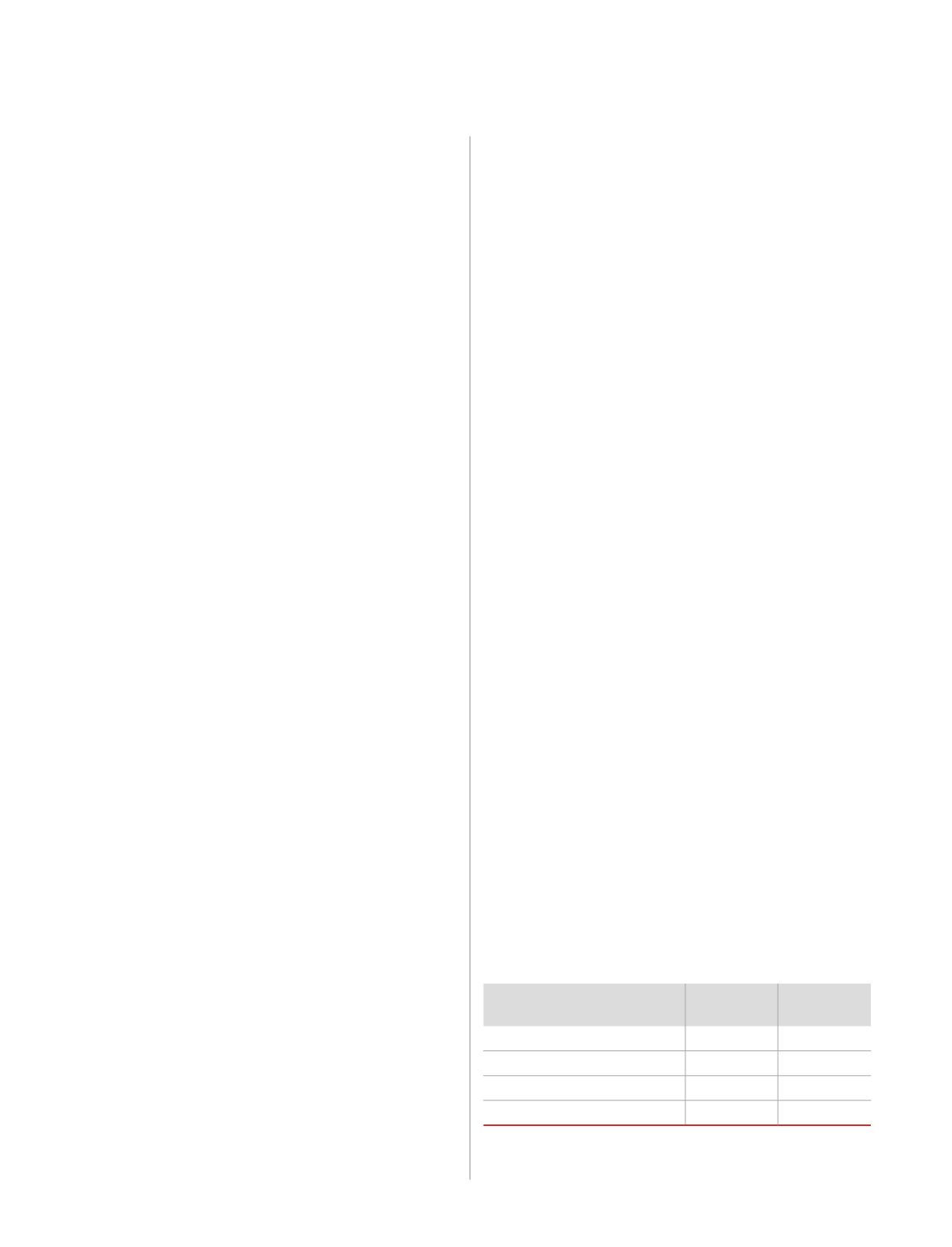

Nomination and Remuneration Committee

During the year 2016-17, no meeting of the Nomination and

Remuneration Committee was held. The composition of the

Committee is as follows:

Name of the Committee

Member

Category

Designation

Mr. Debi Prasad Bagchi

Independent Chairman

Mr. Ashok Kajaria

Executive

Member

Mr. Ram Ratan Bagri

Independent Member

Mr. H. Rathnakar Hegde

Independent Member

The Composition of the Nomination and Remuneration

Committee is as per Section 178 of the Companies Act, 2013

070