226

Notes on the consolidated financial statements

for the year ended 31 March 2017

(

`

in crores)

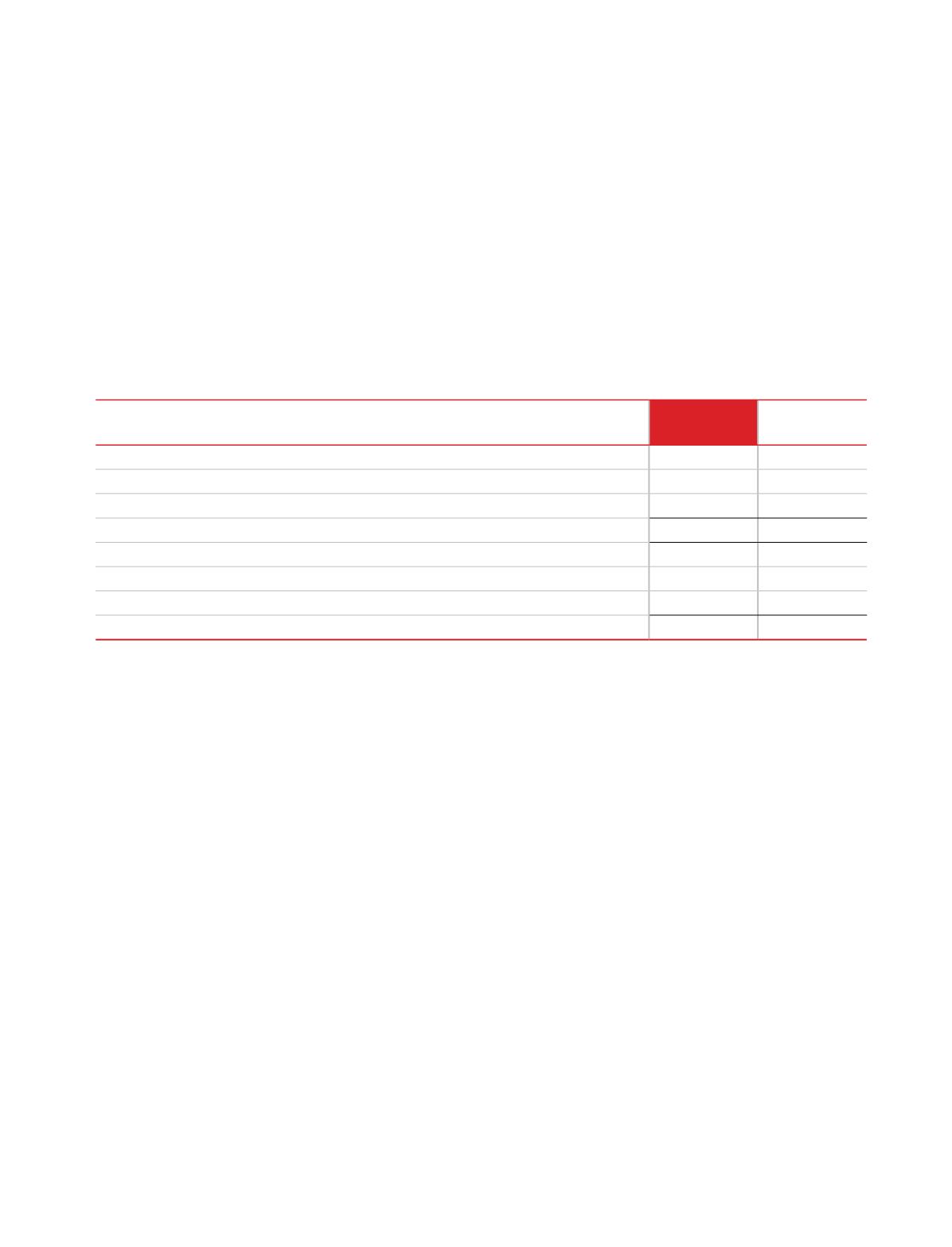

Particulars

Year ended

March 31, 2017

Year ended

March 31, 2016

A. Declared and paid during the year:

Final dividend for FY 2015-16:

`

5 per share (FY 2014-15:

`

4 per share)

47.83

38.14

(Including dividend distribution tax of

`

8.09 crores, FY 2015-16

`

6.36 crores)

47.83

38.14

B. Proposed for approval at the annual general meeting (not recognised as a liability):

Final dividend for FY 2016-17:

`

3 per share (2015-16:

`

5 per share)

47.68

39.74

Dividend distribution tax

9.71

8.09

57.39

47.83

Note: Final dividend for FY 2016-17 is proposed on equity shares of face value of

`

1 per share after share split. All other per

share figures are in respect of equity shares of face value of

`

2 per share.

51 Dividends Paid and Proposed

50 First time adoption of Ind AS

date of transition to Ind ASs, it may do so only if the entity has disclosed publicly the fair value of those equity instruments,

determined at the measurement date as defined in Ind AS 102.

Under Previous GAAP, a company could have used the intrinsic value method or the fair value method. However, Ind AS

102 requires all types of share-based payments and transactions to be measured at fair value and recognised over the

vesting period.

However Ind-AS 101 provides that requirements of Ind-AS 102 can be applied to the options that have been vested only

if the company has publically disclosed the fair value. For options that have not yet vested as at the transition date the

company will need to apply the requirements of Ind-AS 102 retrospectively.