196

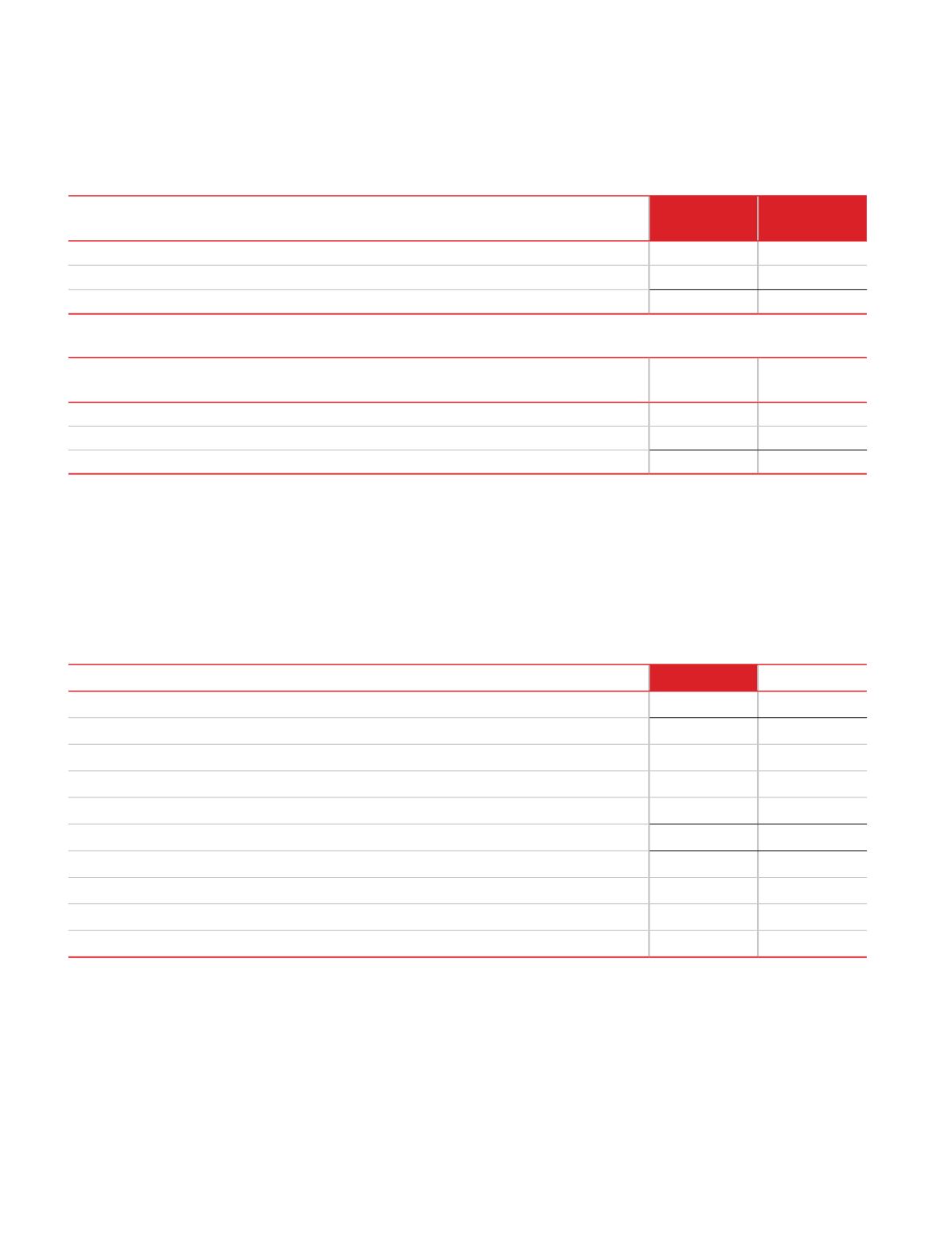

29. Components of other comprehensive income (OCI)

(

`

in crores)

Retained

Earnings

Total

Remasurement gains (losses) on defined benefit plans

(1.10)

(1.10)

Income tax impact

0.38

0.38

(0.72)

(0.72)

The disaggregation of changes to OCI by each type of reserve in equity is shown below:

During the year ended 31 March 2017

(

`

in crores)

Retained

Earnings

Total

Remasurement gains (losses) on defined benefit plans

(1.04)

(1.04)

Income tax impact

0.36

0.36

(0.68)

(0.68)

During the year ended 31 March 2016

30. Earnings Per Share (EPS)

Basic and Diluted EPS amounts are calculated by dividing the profit for the year attributable to equity holders of the company by

the weighted average number of Equity shares outstanding during the year. Diluted EPS are calculated by dividing the profit for

the year attributable to the equity holders of the company by weighted average number of Equity shares outstanding during the

year plus the weighted average number of equity shares that would be issued on conversion of all the dilutive potential Equity

shares into Equity shares.

(

`

in crores)

Particulars

31 March 2017

31 March 2016

Profit / (loss) for the year as per Statement of Profit & Loss

252.12

230.65

Profit / ( loss) attributable to equityholders of the Company for basic earnings

252.12

230.65

No. crores

No. crores

Weighted average number of equity shares in calculating basic EPS

15.89

15.89

Effect of dilution:

0.04

0.05

Weighted average number of equity shares in calculating diluted EPS

15.93

15.94

Earnings per equity share in

`

Basic

15.86

14.51

Diluted

15.82

14.47

Face Value of shares

1

1

Note:

The earning per share (EPS) of the year ended 31 March 2016 has been reinstated to consider the impact of share split during

the current year. Refer note 13c for details

The following reflects the income and share data used in the basic and diluted EPS computations:

Notes on the consolidated financial statements

for the year ended 31 March 2017