201

annual

report

20

16-17

kajaria

ceramics

corporate

overview

management

reports

Financial

statements

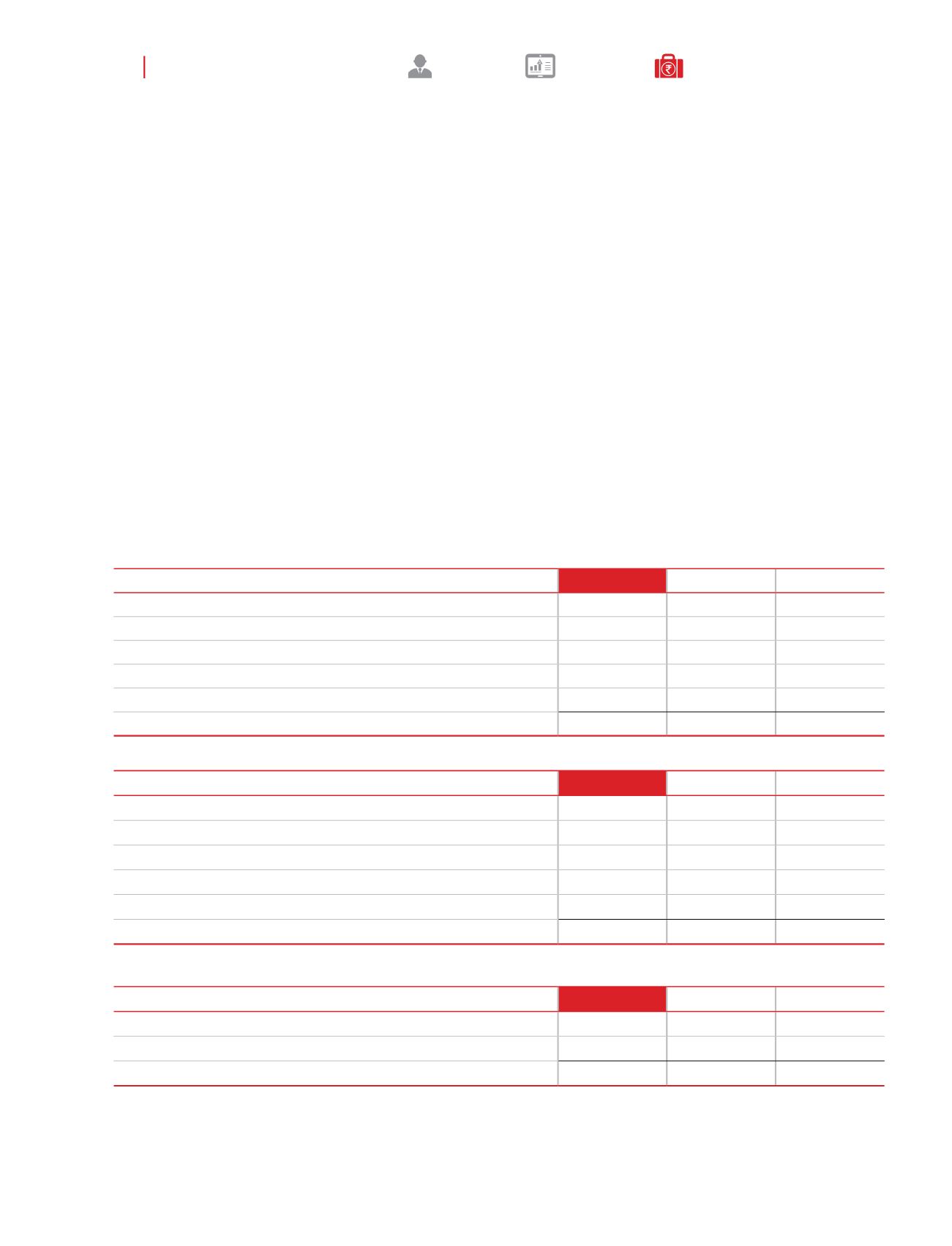

32.

In the opinion of the Management current assets have a value on realisation in the ordinary course of business at least equal to

the amount at which they are stated except where indicated otherwise.

33. Employee benefit plans

Defined Contribution Plans - General Description

Retirement benefits in the form of provident fund, superannuation fund and national pension scheme are defined contribution

schemes. The Company has no obligation, other than the contribution payable to the provident fund. The Company’s

contribution to the provident fund is

`

7.11 crores (31 March 2016

`

6.53 crores)

Defined Benefit Plans - General Description

Gratuity:

The Company has a defined benefit gratuity plan. Gratuity is computed as 15 days salary, for every completed year of service or

part thereof in excess of 6 months and is payable on retirement / termination / resignation. The benefit vests on the employee

completing 5 years of service. The Gratuity plan for the Company is a defined benefit scheme where annual contributions

are deposited to an insurer to provide gratuity benefits by taking a scheme of Insurance, whereby these contributions are

transferred to the insurer. The Company makes provision of such gratuity asset/liability in the books of accounts on the basis

of actuarial valuation as per the projected unit credit method. Plan assets also include investments and bank balances used to

deposit premiums until due to the insurance company.

(

`

in crores)

31 March 2017

31 March 2016 1 April 2015

Defined benefit obligation at the beginning of the year

20.56

17.25

13.74

Current service cost

3.01

2.07

1.85

Interest cost

1.54

1.37

1.09

Benefits paid

(0.83)

(0.75)

(0.45)

Actuarial (gain)/ loss on obligations - OCI

2.45

0.62

1.02

Defined benefit obligation at the end of the year

26.74

20.56

17.25

The following tables summarise the components of net benefit expense recognised in the statement of Profit & loss and

the funded status and amounts recognised in the balance sheet for the gratuity plan:

Changes in the present value of the defined benefit obligation are as follows:

(

`

in crores)

31 March 2017

31 March 2016 1 April 2015

Fair value of plan assets at the beginning of the year

10.32

6.99

4.82

Contribution by employer

4.14

3.86

2.53

Benefits paid

(0.83)

(0.80)

(0.45)

Expected Interest Income on plan assets

0.78

0.69

0.46

Acturial gain/(loss) on plan asset

1.35

(0.42)

(0.37)

Fair value of plan assets at the end of the year

15.76

10.32

6.99

Changes in the fair value of plan assets are, as follows:

(

`

in crores)

31 March 2017

31 March 2016 1 April 2015

Fair value of plan assets

15.76

10.32

6.99

Defined benefit obligation

26.74

20.56

17.25

Amount recognised in the Balance Sheet

10.98

10.24

10.26

Reconciliation of fair value of plan assets and defined benefit obligation:

Notes on the consolidated financial statements

for the year ended 31 March 2017