191

annual

report

20

16-17

kajaria

ceramics

corporate

overview

management

reports

Financial

statements

(

`

in crores)

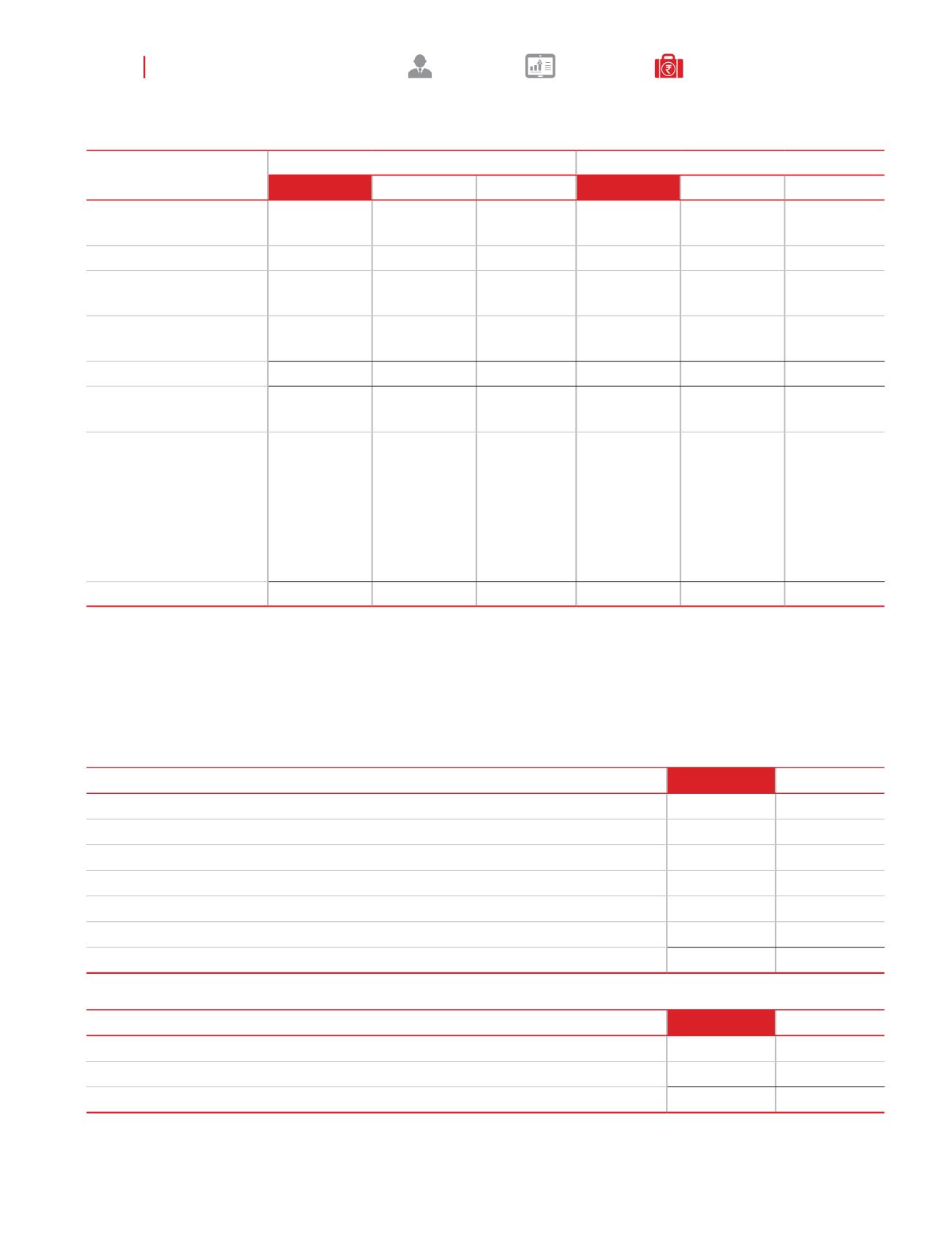

Non-Current

Current

31 March 2017

31 March 2016 1 April 2015

31 March 2017

31 March 2016 1 April 2015

a. Provision for employee

benefits

Provision for gratuity

10.31

9.57

10.26

0.67

0.67

-

Provision for compensated

absences

-

-

-

9.58

8.18

7.42

(Refer note 45 for Ind AS

19 disclosures)

10.31

9.57

10.26

10.25

8.85

7.42

b. Current tax liabilities

(net)

Provision for Tax (Net of

advance tax & TDS)

(Advance tax and TDS-

31 March 2017: 120.62

crores, 31 March 2016:

100.59 crores, 1 April

2015: 75.56 crores)

-

-

-

10.20

12.70

4.83

Total

-

-

-

10.20

12.70

4.83

16. Provisions

(

`

in crores)

31 March 2017

31 March 2016

Current income tax:

Current income tax charge

126.34

111.35

Adjustments in respect of current income tax of previous year

0.07

(0.13)

Deferred tax:

Relating to origination and reversal of temporary differences

16.08

13.49

Income tax expense reported in the statement of Profit & loss

142.49

124.71

The major components of income tax expense for the year ended 31 March 2017 and 31 March 2016 are:

A. Statement of profit and loss:

(i) Profit & loss section

17. Income Taxes

(

`

in crores)

31 March 2017

31 March 2016

Deferred tax related to items recognised in OCI during the year:

Net loss/(gain) on remeasurements of defined benefit plans

0.38

0.36

Income tax charged to OCI

0.38

0.36

(ii) OCI Section

Notes on the consolidated financial statements

for the year ended 31 March 2017