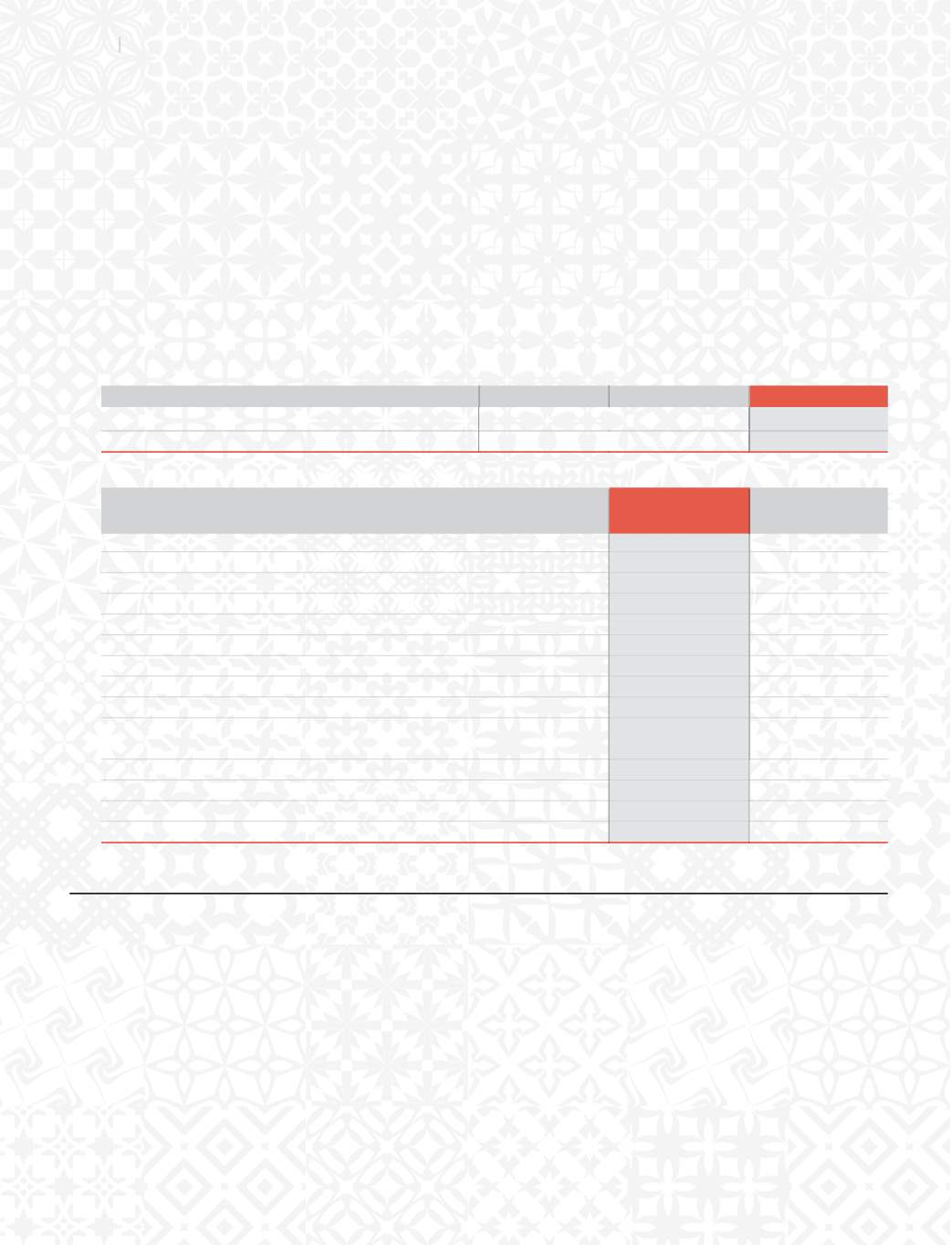

45. Research and Development expenditure incurred from 2011-12 to 2013-14:

Particulars

2011-12

2012-13

2013-14

$BQJUBM &YQFOEJUVSF

3FWFOVF &YQFOTFT

(

`

in million)

Notes on

Accounts

43. Segmental Reporting:

The business activity of the Company falls within one broad business segment viz “Ceramic Tiles” and substantially sale of the

QSPEVDU JT XJUIJO UIF DPVOUSZ 5IF (SPTT JODPNF BOE QSPmU GSPN UIF PUIFS TFHNFOU JT CFMPX UIF OPSNT QSFTDSJCFE JO "4 PG

The Institute of Chartered Accountants of India. Hence the disclosure requirement of Accounting Standard 17 of “Segment

Reporting” issued by the Institute of Chartered Accountants of India is not considered applicable.

44. Share Warrants:

The Company had, in its EOGM dated 6th November, 2013 approved the issuance of 3885420 warrants to M/s. WestBridge

Crossover Fund LLC and as per terms of issue, 25% of the total consideration, amounting to

`

250 million has been received

during the year. Each warrant is convertible into one equity share of

`

2/- each at a premium of

`

255.372433 per share as per SEBI

(ICDR) regulations, 2009 for Preferential issues, within one year from the date of allotment, i.e., 11th November, 2013.

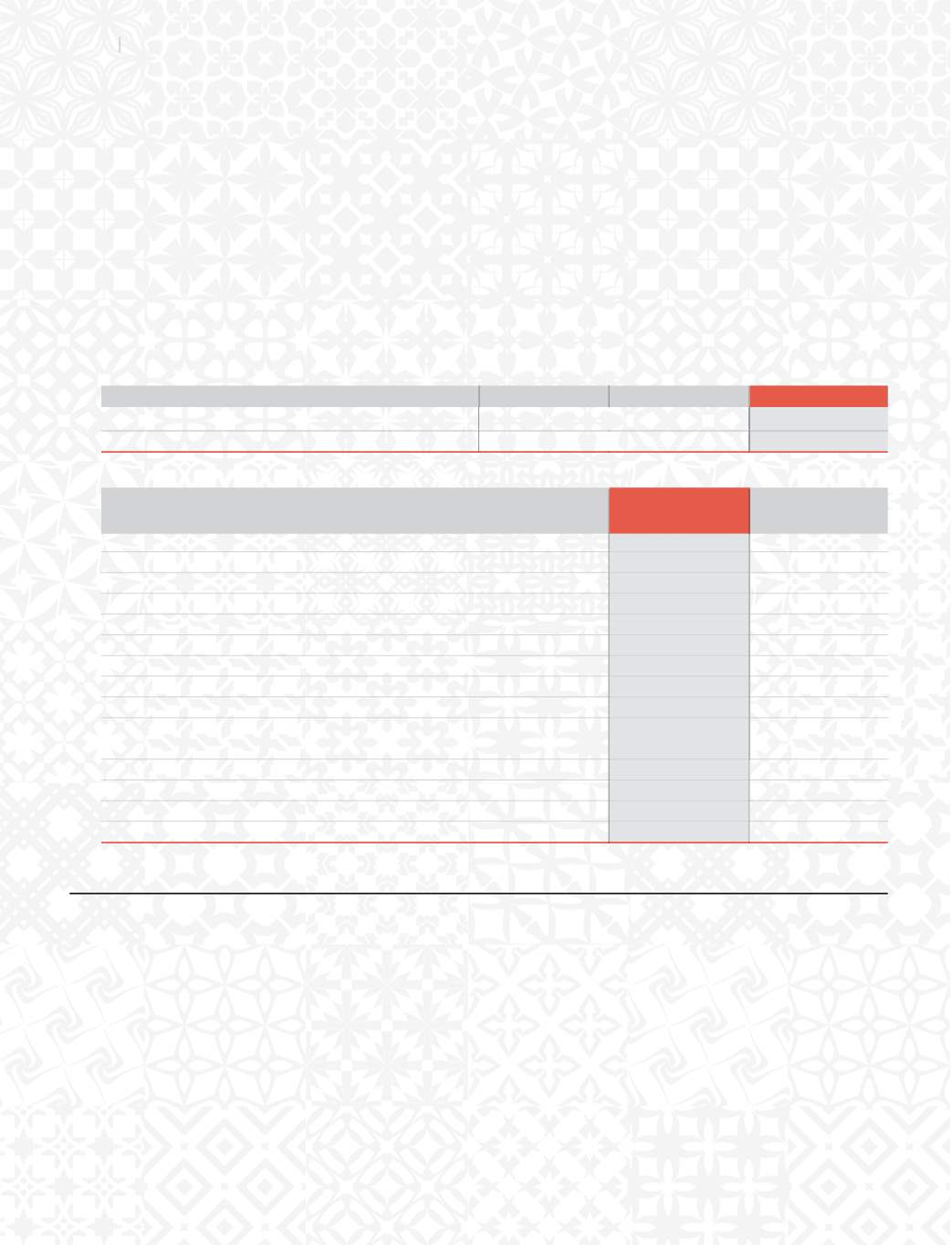

46.

Earnings per share (EPS) –

The numerators and denominators used to calculate Basic and Diluted Earning per share:

Year ended

Year ended

31.03.2014

31.03.2013

Basic Earnings Per Share

1SPmU BUUSJCVUBCMF UP UIF &RVJUZ 4IBSFIPMEFST o "

`

in millions)

1167.44

1005.45

Basic /Weighted average number of Equity Shares outstanding during the year(B)

7,43,56,183

7,35,83,580

Nominal value of Equity Shares (

`

)

2.00

2.00

Basic Earnings per share (

`

) –

(A)/(B)

15.70

13.66

Diluted Earnings Per Share

1SPmU BUUSJCVUBCMF UP UIF &RVJUZ 4IBSFIPMEFST o BT BCPWF

`

in millions)

1167.44

1005.45

*OUFSFTU 1BJE PO 1PUFOUJBM &RVJUZ 4IBSFT OFU PG UBY JNQBDU

`

in millions)

–

–

1SPmU DPOTJEFSFE GPS %JMVUFE & 1 4

$

Basic Weighed average number of Equity Shares outstanding

during the year as above

7,43,56,183

7,35,83,580

Weighted Average Potential Equity Shares for the Year

111,772

–

Total weighted average shares considered for Diluted E.P.S.

(D)

7,44,67,955

7,35,83,580

Nominal value of Equity Shares (

`

)

2.00

2.00

Diluted Earning per share (

`

)-

(C)/(D)

15.68

13.66

47.

5IF $PNQBOZ IBT SFDMBTTJmFE QSFWJPVT ZFBS mHVSFT UP DPOGPSN UP UIJT ZFBS T DMBTTJmDBUJPO

Signature to the Notes 1 to 47

*O UFSNT PG PVS SFQPSU PG FWFO EBUF BOOFYFE

'PS BOE PO CFIBMG PG UIF #PBSE

For

O. P. Bagla & Co.

D. P. Bagchi

Chartered Accountants

R. K. Bhargava

R. R. Bagri

Atul Bagla

Ashok Kajaria

H. Rathnakara Hegde

R. C. Rawat

Partner

Chairman & Managing Director

Sandeep Singhal

&Y 7JDF 1SFTJEFOU " 5

Membership No.: 91885

Directors

Company Secretary

Chetan Kajaria

Place: New Delhi

Rishi Kajaria

Dated: 7th May, 2014

Jt. Managing Directors

72

Kajaria Ceramics Limited