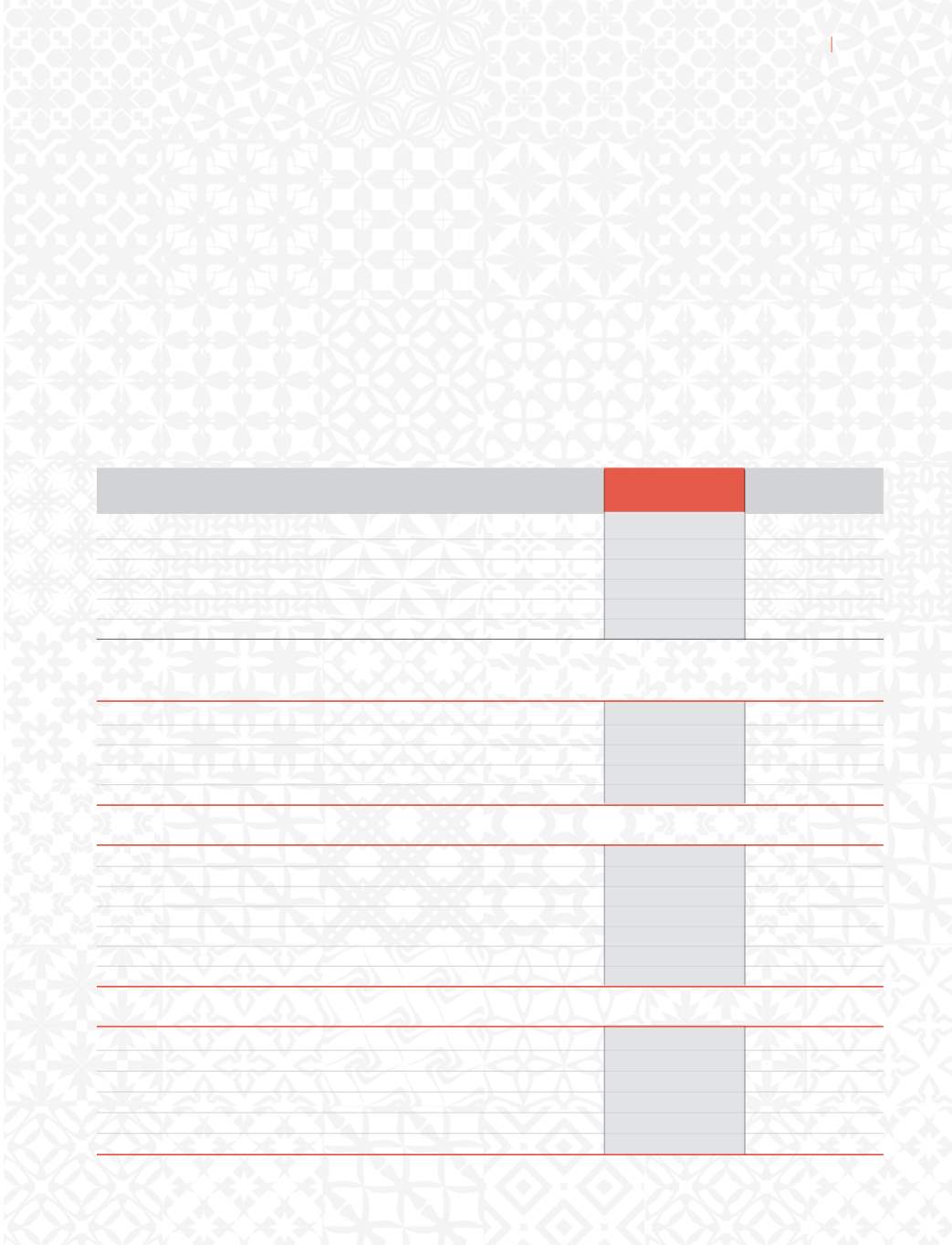

Notes on

Accounts

Balance Sheet

Details of provision for Gratuity

Fair Value of Plan Assets at the end of the period

48.15

23.86

Liability at the end of the period

135.70

111.17

Difference

87.55

87.32

Less: Unrecognised past service cost

NIL

NIL

Amount recognized in the Balance Sheet

87.55

87.32

%FmOFE CFOFmU PCMJHBUJPO BT BU "QSJM

Interest Cost

10.00

7.13

Current service cost

15.51

13.83

#FOFmU QBJE

1BTU 4FSWJDF $PTU o 7FTUFE #FOFmU

o

o

Actuarial losses on obligation

1.97

6.61

%FmOFE CFOFmU PCMJHBUJPO BT BU TU .BSDI

$IBOHFT JO UIF QSFTFOU WBMVF PG UIF EFmOFE CFOFmU PCMJHBUJPO BSF BT GPMMPXT

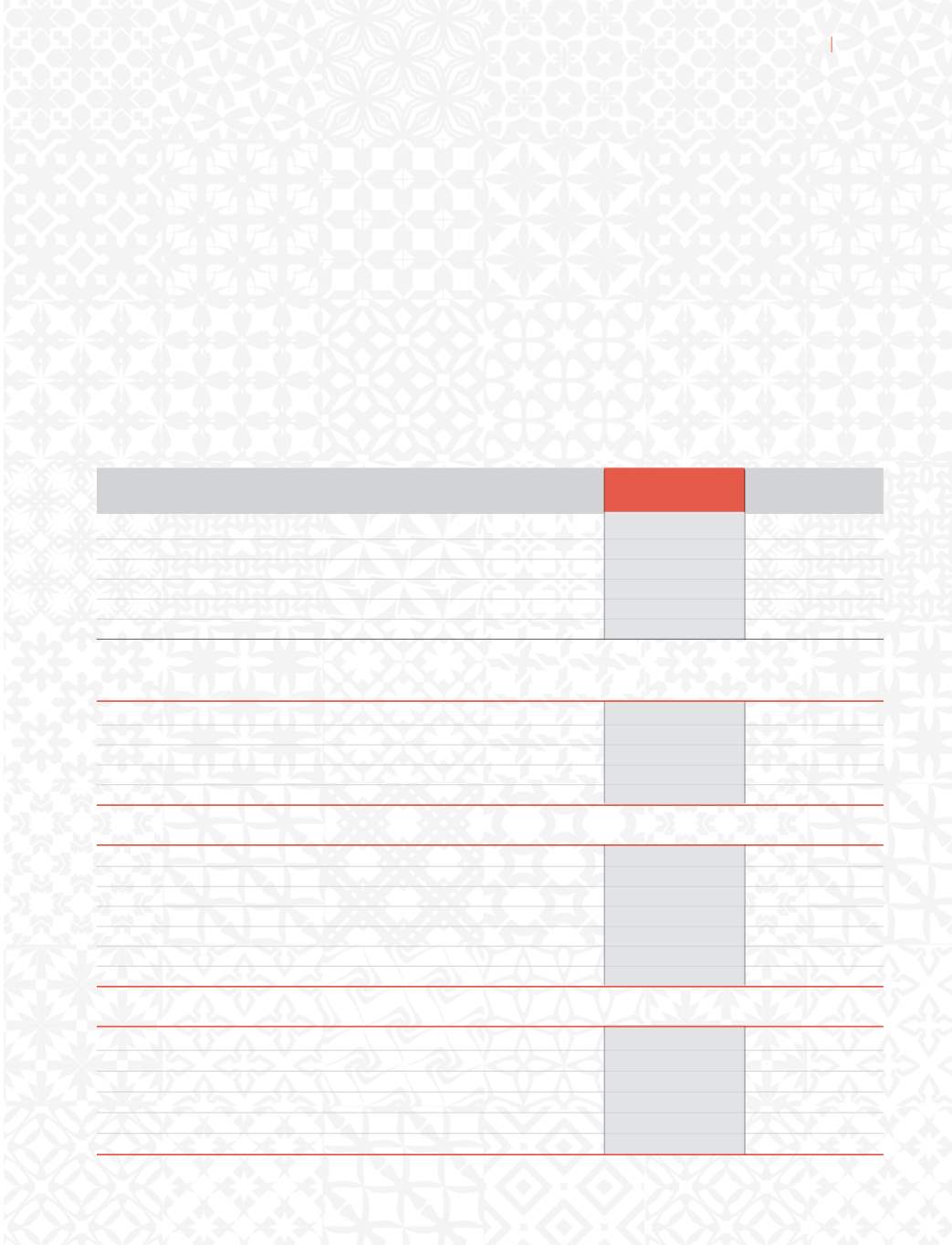

1SPmU BOE -PTT BDDPVOU

/FU FNQMPZFF CFOFmU FYQFOTF SFDPHOJ[FE JO &NQMPZFF DPTU

March 31, 2014

March 31, 2013

`

in million

`

in million

Current Service cost

15.51

13.83

*OUFSFTU DPTU PO CFOFmU PCMJHBUJPO

Net actuarial loss recognized in the year

3.06

6.61

Past service cost

–

–

&YQFDUFE 3FUVSO PO 1MBO "TTFUT

/FU CFOFmU FYQFOTF

directors in the current year, the amount has been written off. Necessary formalities for obtaining regulatory permission from RBI

BSF VOEFSXBZ 4JODF GVMM QSPWJTJPO XBT DSFBUFE JO UIF QSFWJPVT ZFBS UIF XSJUF PGG IBT OP JNQBDU PO DVSSFOU ZFBS QSPmUT

39.

5P DPNQMZ XJUI UIF HVJEBODF OPUF PO i"DDPVOUJOH 5SFBUNFOU PG &YDJTF %VUZw JTTVFE CZ *OTUJUVUF PG $IBSUFSFE "DDPVOUBOUT PG

*OEJB FYDJTF EVUZ BNPVOUJOH UP

`

124.43 million (previous year

`

135.34 million) has been included in the value of inventories

BT PO

BOE UIF DPSSFTQPOEJOH BNPVOU PG &YDJTF %VUZ QBZBCMF IBT CFFO JODMVEFE JO PUIFS MJBCJMJUJFT )PXFWFS UIJT

BDDPVOUJOH QPMJDZ IBT OP JNQBDU PO UIF QSPmU GPS UIF ZFBS

40.

(SBUVJUZ "OE 0UIFS 1PTU &NQMPZNFOU #FOFmU 1MBOT

5IF $PNQBOZ IBT B EFmOFE CFOFmU HSBUVJUZ QMBO (SBUVJUZ CFJOH BENJOJTUFSFE CZ B 5SVTU JT DPNQVUFE BT EBZT TBMBSZ GPS

FWFSZ DPNQMFUFE ZFBS PG TFSWJDF PS QBSU UIFSFPG JO FYDFTT PG NPOUIT BOE JT QBZBCMF PO SFUJSFNFOU UFSNJOBUJPO SFTJHOBUJPO

5IF CFOFmU WFTUT PO UIF FNQMPZFF DPNQMFUJOH ZFBST PG TFSWJDF 5IF (SBUVJUZ QMBO GPS UIF $PNQBOZ JT B EFmOFE CFOFmU TDIFNF

XIFSF BOOVBM DPOUSJCVUJPOT BSF EFQPTJUFE UP B (SBUVJUZ 5SVTU 'VOE FTUBCMJTIFE UP QSPWJEF HSBUVJUZ CFOFmUT 5IF 5SVTU 'VOE IBT

taken a Scheme of Insurance, whereby these contributions are transferred to the insurer. The Company makes provision of such

gratuity asset/liability in the books of accounts on the basis of actuarial valuation as per the Projected unit credit method. Plan

assets also include investments and bank balances used to deposit premiums until due to the insurance company.

5IF GPMMPXJOH UBCMFT TVNNBSJ[F UIF DPNQPOFOUT PG OFU CFOFmU FYQFOTF SFDPHOJTFE JO UIF QSPmU BOE MPTT BDDPVOU BOE UIF

funded status and amounts recognized in the balance sheet for the plan:

Fair value of plan assets as at 1st April, 2013

23.85

24.35

Return on Plan Assets

3.24

2.50

Contributions by employer

25.10

–

#FOFmUT QBJE

Actuarial Gains / (losses)

(1.09)

–

Fair value of plan assets as at 31st March, 2014

48.15

23.86

Changes in the fair Value of plan assets are as follows:

67

Annual Report 2013-14