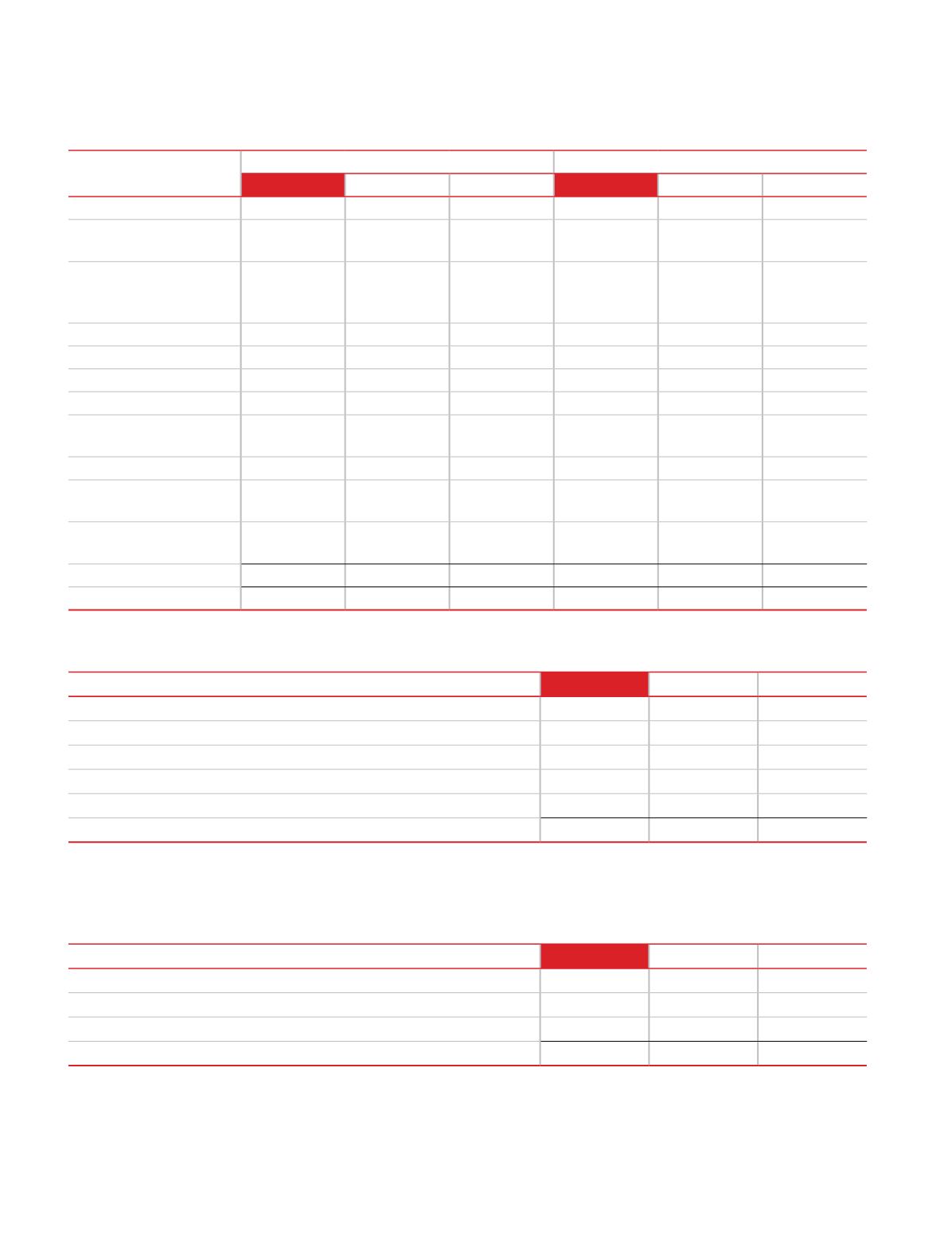

180

(

`

in crores)

Non Current

Current

31 March 2017

31 March 2016 1 April 2015

31 March 2017

31 March 2016 1 April 2015

Capital advances

Unsecured, considered

good

2.68

3.35

11.35

-

-

Other loans and advances

(Unsecured, considered

good)

Advance to suppliers

-

-

18.47

12.76

10.25

Prepaid expenses

-

-

4.65

4.75

1.92

Export benefit receivables

-

-

0.16

0.12

0.71

Income tax advances

7.32

4.04

3.53

-

-

-

Balance with statutory

authorities

CENVAT Credit Receivable

0.69

-

-

22.11

32.17

22.84

VAT Credit receivable-

OCA

1.40

-

-

5.50

13.46

6.25

Service tax credit

receivable-OCA

-

-

5.45

5.51

3.18

9.41

4.04

3.53

56.34

68.77

45.15

Total

12.09

7.39

14.88

56.34

68.77

45.15

7. Other non-financial assets

(

`

in crores)

31 March 2017

31 March 2016 1 April 2015

Raw Materials

60.21

58.41

51.34

Work-in-progress

24.57

28.25

10.99

Finished Goods

215.96

216.92

182.70

Stock in trade

23.49

31.49

17.51

Stores and spares

47.79

49.10

40.78

Total

372.02

384.17

303.32

Note:

For mode of valuation refer Accounting policy number 2.3 (h)

8. Inventories

(

`

in crores)

31 March 2017

31 March 2016 1 April 2015

Unsecured, considered good

336.68

272.70

213.37

Unsecured, considered doubtful

3.53

2.36

2.22

Less: Provision for doubtful receivables

(1.29)

(0.95)

(0.39)

Total

338.92

274.11

215.20

Note:

No trade or other receivable are due from directors or other officers of the company either severally or jointly with any other person.

Nor any trade or other receivable are due from firms or private companies in which any director is a partner, director or a member.

Trade receivables are non interest bearing and are generally on credit terms of 30 days.

9. Trade receivables (unsecured)

Notes on the consolidated financial statements

for the year ended 31 March 2017