132

33. Employee benefit plans

(contd...)

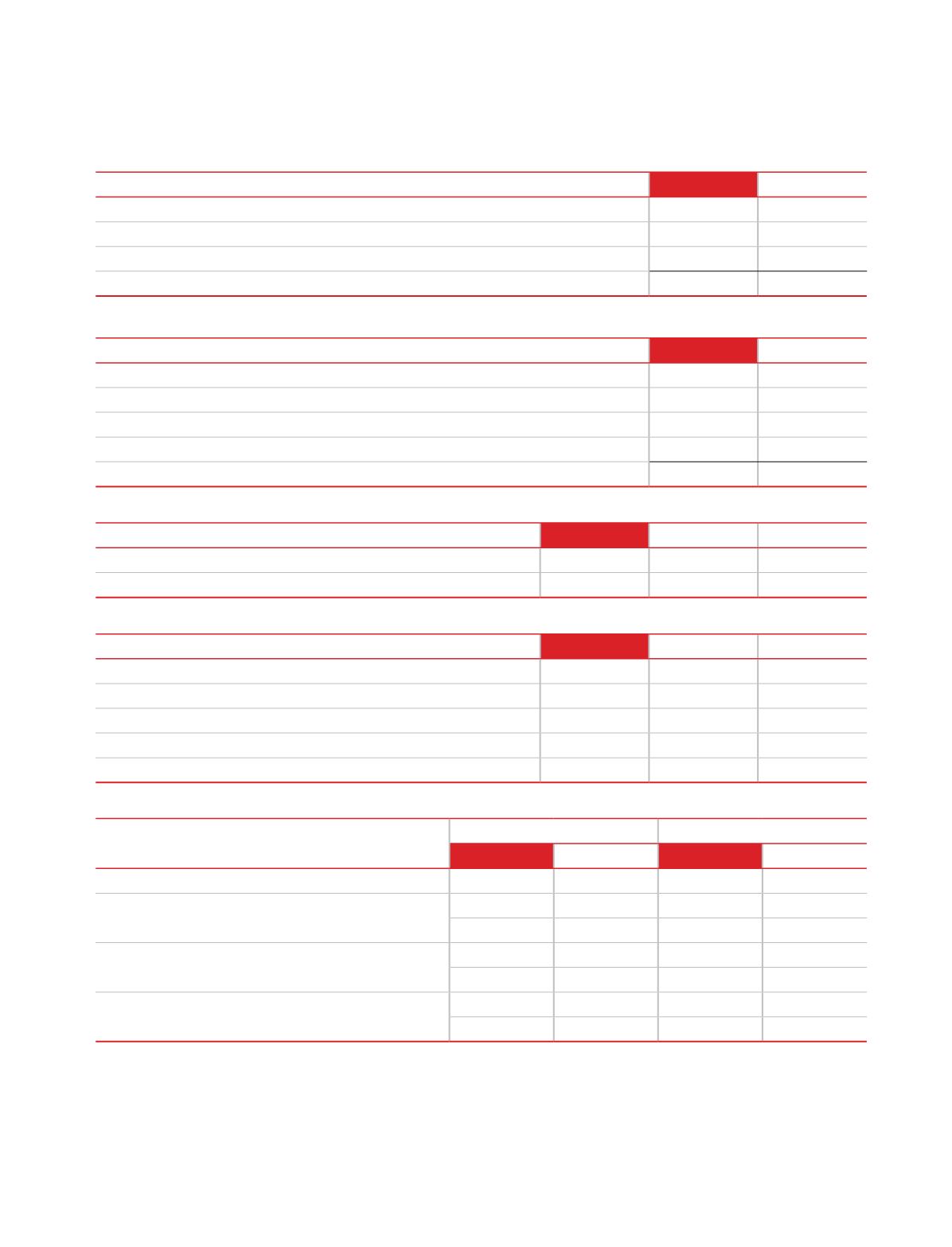

The principal assumptions used in determining gratuity liability for the Company’s plans are shown below:

31 March 2017

31 March 2016 1 April 2015

Discount rate

7.50%

8.00%

8.00%

Expected rate of return on Plan assets

7.50%

8.00%

7.75%

Future salary increases

8.50%

8.00%

7.75%

Attrition Rate

1.00%

1.00%

1.00%

Retirement age

60 years

60 years

60 years

The major categories of plan assets of the fair value of the total plan assets are as follows:

Gratuity

31 March 2017

31 March 2016 1 April 2015

Investment Details

Funded

Funded

Funded

Investment with Gratuity funds

100%

100%

100%

(

`

in crores)

31 March 2017

31 March 2016

Current service cost

2.63

2.07

Interest expense

1.52

1.36

Expected return on plan asset

(0.78)

(0.69)

Amount recognised in Statement of Profit and Loss

3.37

2.74

Amount recognised in Statement of Profit and Loss:

(

`

in crores)

31 March 2017

31 March 2016

Actuarial changes arising from changes in demographic assumptions

-

-

Actuarial changes arising from changes in financial assumptions

2.38

0.59

Return on plan assets (excluding amounts included in net interest expense)

-

-

Experience adjustments

(1.35)

0.43

Amount recognised in Other Comprehensive Income

1.03

1.02

Amount recognised in Other Comprehensive Income:

(

`

in crores)

Gratuity Plan

Sensitivity level

Impact on DBO

31 March 2017

31 March 2016

31 March 2017

31 March 2016

Assumptions

Discount rate

+1%

+1%

(3.18)

(2.46)

-1%

-1%

3.82

2.91

Future salary increases

+1%

+1%

3.72

2.86

-1%

-1%

(3.15)

(2.46)

Withdrawal rate

+1%

+1%

(0.31)

(0.02)

-1%

-1%

0.35

0.02

A quantitative sensitivity analysis for significant assumption as at 31 March 2017 is as shown below:

The sensitivity analyses above have been determined based on a method that extrapolates the impact on defined benefit

obligation as a result of reasonable changes in key assumptions occurring at the end of the reporting period.

Sensitivities due to mortality and withdrawals are insignificant and hence ignored.

Sensitivities as to rate of inflation, rate of increase of pensions in payments, rate of increase of pensions before retirement & life

expectancy are not applicable being a lump sum benefit on retirement.

Notes on the standalone financial statements

for the year ended 31 March 2017