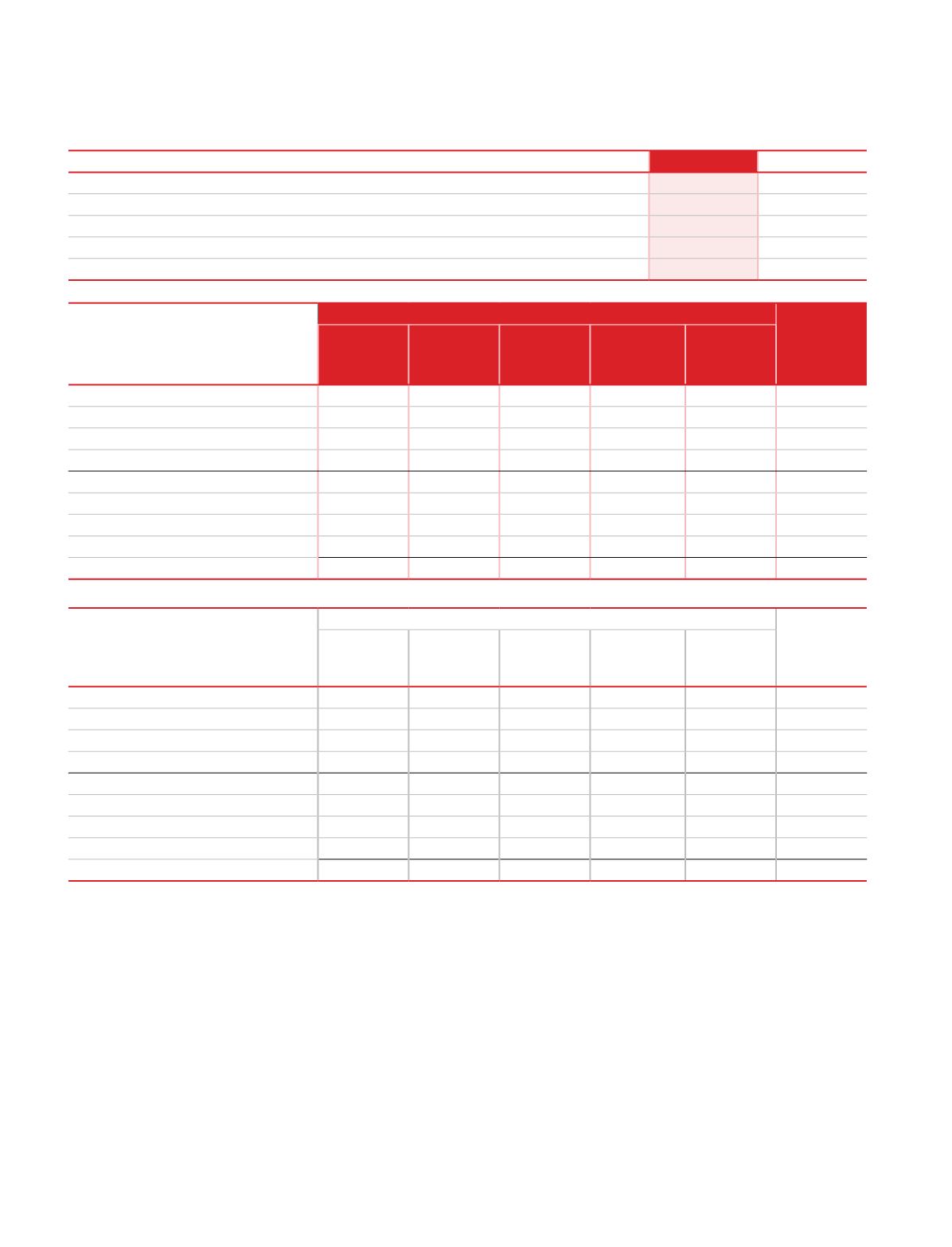

104

Statement of changes in equity

for the year ended 31 March 2017

(

`

in crores)

Particulars

Note

Amount

As at 1 April 2015

13

15.89

Changes during the year

-

As at 31 March 2016

13

15.89

Changes during the year

-

As at 31 March 2017

13

15.89

A. Equity share capital for issued, subscribed and paid up equity share of

`

1/- each

As at 1 April 2017

Reserves and Surplus

Total

equity

General

Reserve

Securities

Premium

Reserve

Capital

redemption

reserve

Share options

outstanding

account

Retained

earnings

As at 1 April 2016

245.37

163.06

5.00

0.83

526.01

940.27

Net income / (loss) for the year

270.16

270.16

Transfer to general reserve

75.00

(75.00)

-

Other comprehensive income (Note 29)

(0.67)

(0.67)

Total comprehensive income

75.00

-

-

-

194.49

269.49

Employee stock option scheme

1.87

1.87

Dividend

(39.74)

(39.74)

Dividend distrubution tax

(8.09)

(8.09)

At 31 March 2017

320.37

163.06

5.00

2.70

672.67

1,163.80

Significant accounting policies

1&2

B. Other equity (Refer note 14)

The accompanying Notes 1 to 51 form an integral part of these financial statements.

In terms of our report of even date annexed

For and on behalf of the Board

For O. P. Bagla & Co.

Ashok Kajaria

Chetan Kajaria

Rishi Kajaria

Chartered Accountants

Chairman & Managing Director

Jt. Managing Director

Jt. Managing Director

FRN No. 000018N

(DIN: 00273877)

(DIN: 00273928)

(DIN: 00228455)

Atul Bagla

Partner

Ram Chandra Rawat

Sanjeev Agarwal

Membership No.: 91885

COO (A&T) and Co. Secretary

CFO

Place: New Delhi

(FCS No. 5101)

Dated: 15th May, 2017

As at 1 April 2016

Reserves and Surplus

Total

equity

General

Reserve

Securities

Premium

Reserve

Capital

redemption

reserve

Share options

outstanding

account

Retained

earnings

As at 1 April 2015

185.37

163.06

5.00

-

387.81

741.24

Net income / (loss) for the year

237.00

237.00

Transfer to general reserve

60.00

(60.00)

-

Other comprehensive income (Note 29)

(0.67)

(0.67)

Total comprehensive income

60.00

-

-

-

176.33

236.33

Employee stock option scheme

0.83

0.83

Dividend

(31.77)

(31.77)

Dividend distrubution tax

(6.36)

(6.36)

At 31 March 2016

245.37

163.06

5.00

0.83

526.01

940.27

Significant accounting policies

1&2